Where Are We Headed: Inflation, Asset Markets, Currencies, Commodities & Precious Metals.

by: David J Mitchell

Founding Partner – Auctus Metal Portfolios

As global asset markets collapse in value, investors and portfolio managers need to step back and understand what is required in terms of portfolio diversification and how best to take advantage of the enormous opportunities and risks ahead. The scale of the negative macro developments taking place is occuring at great pace; and for the sake of the length of this article, I will need to be somewhat measured in the time spent analysing some of them in turn.

When it comes to Gold (and broadly, a basket of precious metals), the investing public still seems to be fixated with the erroneous fact that it is an inflation hedge and many are confounded that Gold has not been outperforming at a time when inflation is skyrocketing globally.

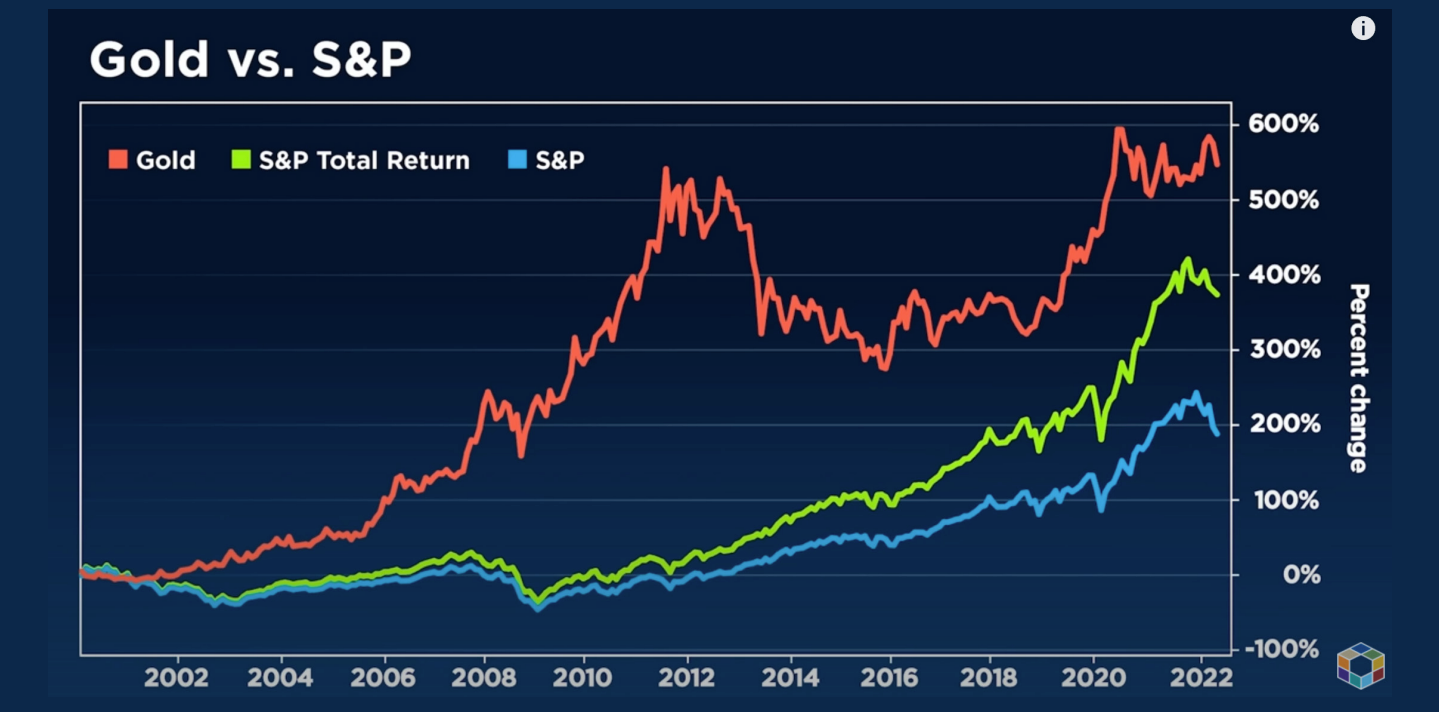

To put it simply, Gold has never been an inflation hedge. It is a crisis hedge and performs spectacularly well within that construct. Gold has proven to be the preeminent holder of long term value and wealth over the last 100 years. In the short term it can be driven negatively by global liquidity issues or asset market capitulations, but in the medium term its performance goes unquestioned.

Central Banks are tightening monetary policy at the same time the global commodities shock is intensifying within its overall super-cycle (higher). The contraction in liquidity funding and broad money supply is taking place at the fastest rate we have seen in 50 years’ worth of data. This begs the question from investors, where is this all leading too?

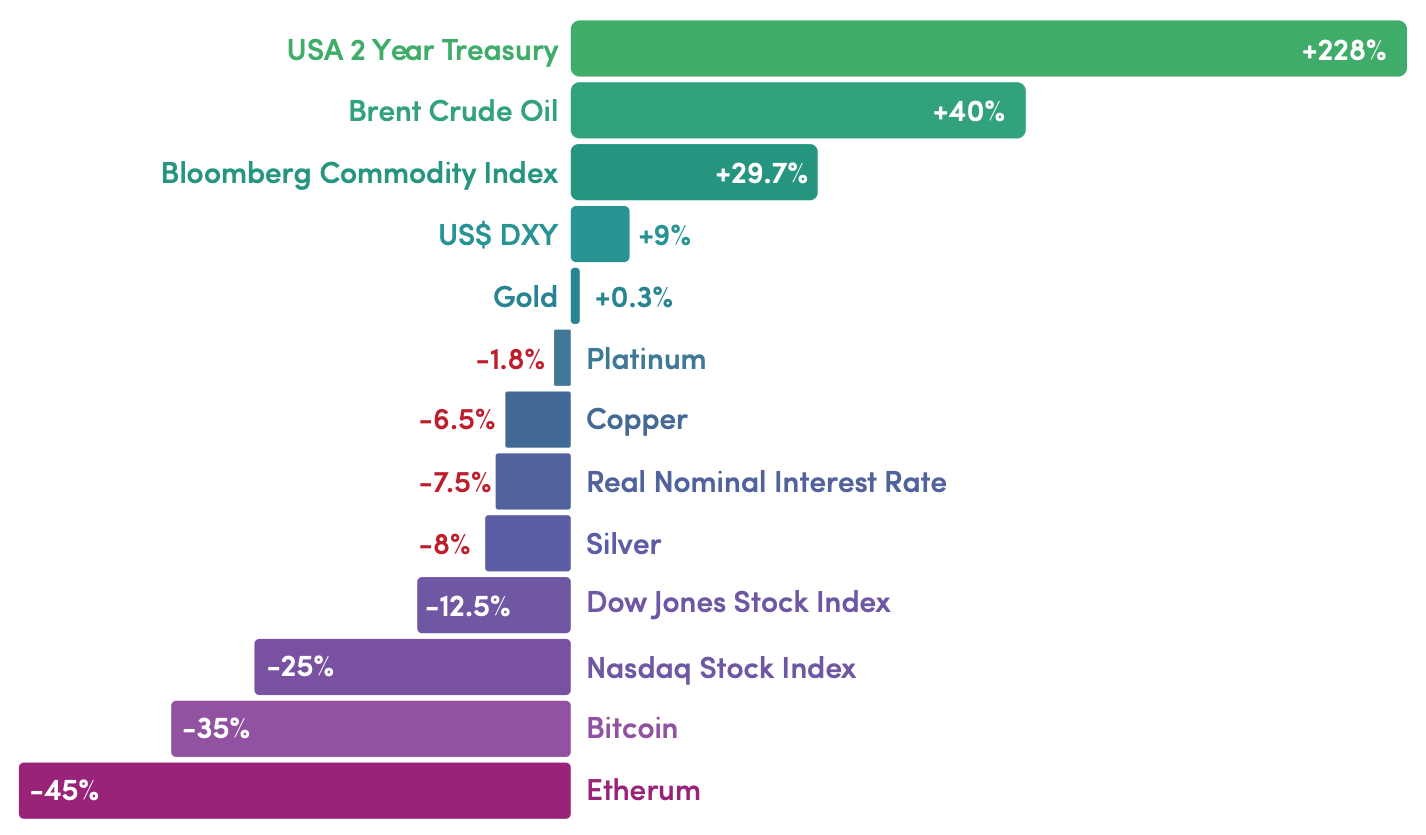

If we assess the price movements of some of the more ‘publicly aware’ asset classes and markets into perspective, we can then ascertain what is driving them, where we are headed and what our clients need to be aware of.

1 January 2022 – 16 May 2022 versus the USD.

- Gold : +0.3%

- Platinum : -1.8%

- Silver : -8%

- Nasdaq Stocks Index : -25%

- Dow Jones Stock Index: -12.5%

- Bitcoin : -35%

- Etherum : -45%

- Copper : -6.5%

- Brent Crude Oil : +40%

- DXY $ : +9% (DXY Index – value of the United States Dollar relative to a basket of foreign currencies)

- USA 2 Year Treasury : +228% (Debt Yield)

- Real Nominal Interest Rates : -7.5% (Central Bank Funds Rates minus Inflation – Historically the most negative it has been since the 1940s)

- Bloomberg Commodity Index : +29.7% (represents 21 global commodities which are weighted to account for economic significance and market liquidity)

Gold together with the other key precious metals, has been caught up in a broader sell-off in commodities (which we believe is entirely misguided, purely paper driven exchanges driving capitulation and stops), driven in large part since late April of this year, with the news of China’s worsening COVID outbreak, their extreme lockdown policies and the consequent threat to demand for basic materials.

However China’s Gold demand for example, has returned to pre-COVID levels. The extreme volatility and declines seen in the Chinese stock market and real estate markets have sparked investment demand for Gold.

The Gold price today (US$1810/oz) is lower than it was on 24 February 2022, the day that Russia invaded Ukraine. The so-called ‘crisis premium’ for Gold (which rose from below US$1,900oz to US$2,070oz initially) appears to have relinquished entirely, despite the ongoing impact of war in Europe, a growing and worsening geo-political crisis, massive and rising global inflation, global food panic, shortages and the UN predicting food US$ DXY Bloomberg Commodity Index Brent Crude Oil USA 2 Year Treasury +228% +40% +29.7% +9% +0.3% -1.8% -6.5% -7.5% -8% -12.5% -25% -35% -45% Gold Platinum Copper Real Nominal Interest Rate Silver Dow Jones Stock Index Nasdaq Stock Index Bitcoin Etherum famines in 2023, which will almost certainly cause substantial civil unrest in countries like Egypt and across Africa and lead to further, sustained food inflation globally.

Global Funding Liquidity, Volatility and Debt Rollovers:

The Global Debt Crisis (the giant elephant in the room) and more importantly the global liquidity required to support the serviceability of the debt markets (hence the funding liquidity conduits*) are at the very forefront of this equation*

*liquidity providers are a complete function of the combination of Central Bank policies, the banking system, shadow banking, major corporations as well as global capital flows.

Global debt is reported at over US$300 trillion currently, with the global average maturity of this debt issued at roughly 5 years. Based on present global debt levels that simply translates to circa. US$60 trillion equivalent of global debt that must be rolled over on an annual basis (alongside the tide of rising interest rates). This does not include new debt issuance as a significant majority of countries around the world continue to deficit spend (borrowing). This whole house of cards critically relies on funding liquidity which is dramatically shrinking and which will further aggravate the debt markets, as serviceability costs continue to spiral.

The implications are that asset markets across the board are looking incredibly vulnerable, especially considering that over 90% of the world’s monetary authorities are presently tightening.

Normal cyclical monetary tightening generally leads to approximately…..

- -15% fall in the stock markets (this is not a normal cycle tightening, but in our view, this time is really quite unprecedented).

- Recessionary forces developing which generally leads to approximately -30% fall in stock markets (forward macro indicators are clearly pointing to a global recession presently)

- And finally; a liquidity & banking crisis, which generally leads to a fall in stock markets of over -50% (which at this time we do not predict. (please see the reasoning below)

US$ Carry Trade:

I have written about this many times over the last 5 years when studying how the overall markets will develop and the mechanics of US$ shortages. I wrote an article in 2019 talking about the USD rally Read Here. Bullion dealers generally talk about the demise of the USD (they don’t appear to understand or fully comprehend global capital flows), where in fact the final part of the global crisis (from my analysis, this will take us into 2024 and 2025) we will see a dramatic rise in the USD vs. global currencies and not a falling USD. This is due to the size of the carry trade which is estimated at between US$12 trillion and US$17 trillion (naked short USD FX exposure), alongside that over US$200 trillion of notional derivatives priced in USD.

A rising USD on the FX markets will cause dramatic tightening of monetary policy globally, which in turn compounds Central Bank tightening. We are presently seeing a crisis of very high USD valuations which are at critical levels across the board of currency markets at this stage.

Central Banks Tighten Until Something Breaks:

Under intense political pressure due to the pace with which inflation is scaling higher, Central Banks, and especially The Fed, find themselves significantly behind the curve. They have inadvertently allowed this situation to fester, following an extended period of incredibly loose monetary policy.

I would strongly suggest that our Central Banks can no longer rectify this situation, it is simply too late. The reliance on the hope that global demand will be destroyed in order to bail them out appears highly misplaced. They will therefore continue to tighten until…

a) something breaks economically or,

b) the stock markets enter a watershed collapse or the debt markets start to convulse and the cost of debt rollovers and serviceability become so strained that defaults start to occur or,

c) global recessionary forces overwhelm them.

In my opinion, varying degrees of all three look to be very much on the cards, at which point our policy leaders will be backed into a corner with a very hard choice and the case of Stagflation, both front and centre.

The 2 scenarios which Central Banks may adopt are:

- Continue to monetarily tighten and fight the inflation monster, which was actually created by them in the first place as a result of their monetary debasement or ‘Modern Monetary Theory’ (MMT) policies, originally formed as an attempt to grow their way out of the global debt crisis. This will drive the world into a great global recession, which will have much deeper repercussions this time round, given that we have the largest global debt crisis in history. A deflationary collapse of the debt markets will tear the monetary system apart and asset markets will move into freefall: A Great Depression.

- Reverse policy 180 degrees and put aside monetary tightening in favour of the monetary spigots once again to fight off the worst effects of the global recessionary forces, while abandoning the fight on inflation. Based on the debt markets and severity and scale of the debt crisis, rising yields by 2% to 2.5% are the levels that I am looking at before the system obviously starts to crack. This leads us into global Stagflation and eventual Hyper-Stagflation, not pretty, but less devastating repercussions than that of a great depression.

Physiological Trigger Within Global Markets – Pre-Conclusion

Once our monetary authorities revert back to monetary expansion and lowering interest rates yet again based on the global crisis (whichever way it develops), this will be a trigger point that global investors will no longer be able to ignore. We are in the largest monetary debasement event in history and this is when stock markets will start a new trend to new highs in the years ahead (this will eventually not end well however) and commodity inflation moves into hyperdrive within the greater commodity supercycle. Demand destruction from elevated prices will have its role to play in dampening commodity price inflation, but this will be limited in the bigger picture.

Precious metals will lead the charge from their extreme current undervaluations and will far outperform other asset classes in percentage terms.

In analysing historical markets and price developments, a recognition of where we are within the overall cycles is of paramount importance. On every occasion our policy leaders & Central Banks lose control of market prices and valuations, namely towards the last 15% of the cycle (from 2023 and into 2025 in this case), we will see a considerable outperformance of precious metal markets. Cyclical Analysis: Read Here.

The number of ‘tailwinds’ supporting major revaluations in the commodity complex and especially the precious metals are frankly insurmountable at this stage. The general (retail) public has yet to awaken, but smart money is now rapidly moving in.

In my Big Analysis piece in January 2022, this year is really going to be the final entry opportunity to build a strong position in precious metals, taking advantage to buy the dips using seasonal trends as a strong guide. I believe that from 2023 into 2025 the precious metals market is going to absolutely explode, ultimately leading us directly into the new monetary system.

In the 1930’s a Great Depression was triggered by policy makers; and in a sign of policy overreach, the USA nationalised gold (making it illegal for private ownership) in 1933. Once completed, they revalued Gold by +70% with FDR (Roosevelt) having raised the official price from $20.67 to $35.00 per troy ounce.

Investors however, were already moving into Gold miners as a proxy to actually owning gold and enjoyed over 800% returns within the depressionary cycle.

In the 1970’s, precious metals finally found a top in 1980 after a +2,700% move higher in Gold, when The Fed was finally forced into pushing interest rates several percentage points over and above inflation. Interest rates hit +19% and moved into positive nominal territory as a result (Interest rates minus Inflation = a positive number). This time around, this will not be possible, due to the sheer scale of our global debt crisis and leverage within our global monetary system.

In the 2003 to 2011 Gold cycle, the precious metals rally (+600% move) ended with zero percent interest rates and a tsunami of public government policy money printing (which is still ongoing 11 years later). That pushed investors and the managed money markets into both stocks and property (who says we did not see extreme inflation between 2010 to 2020?). The inflationary price revaluations across these two asset classes was simply enormous).

This time round, we have extreme historical overvalued bubbles in everything versus the commodity sector with precious metals trading at extreme undervaluations; coupled www.auctusmetals.com Auctus Metal Portfolios Pte Ltd Company Registration: 201828518M, 23 Amoy Street, Singapore 069858 with a debt mountain of historic proportions, forward macro indicators pointing to a roll-over in the world economy that is very clearly pointing to Stagflation of a scale that will sadly put the 1970s to shame. Geo-political tensions are extreme, the USA M2 money supply has expanded +42% in just the last 2 years alone (!) making it the largest monetary expansion ever recorded in economic history. Then you have global supply/ demand deficits and backwardation curves in precious metals, ore grade degradation at the mining level as well as rapidly rising costs of production.

My personal view is that if anyone is neutral or bearish metals in the medium term, they likely do not have a firm grasp of the implications of the global macroeconomic picture and what is to come.

Conclusion Timing

From a timing perspective, there are a great deal of moving parts in this global macro overlay, but there are a plethora of economic surveys and indicators that are pointing to the global recession coming home to roost a lot sooner than most people envisage. Europe and the UK are deteriorating very rapidly, the USA reported a -1.4% contraction in GDP in Q1, 2022 and are further pointing to another contraction in Q2 (recession is officially recorded following 2 quarters of contraction) and global debt markets are already convulsing.

Official policy reversal back into monetary expansion by the end of the summer this year and into the last quarter of 2022 appears to be in the preparatory stages, helped on by the strong political support for continued monetary debasement due to the sheer overwhelming threat of depressionary forces. We forecast that by September 2022, we will be entering the last 15 % to 20% of the time cycle within precious metals, where revaluations into 2025 will become not only extremely elevated, but where price controls are entirely lost.

Timing entries and diversification into physical precious metals with zero third party liability and fully allocated storage has never been so important.