The perfect storm continues to escalate, the centre of this storm or ‘for want of a better word’ the cancer driving this global crisis is the every growing ‘Global Debt Crisis’ that has a mathematical and immutable destination with a brick wall and morphing into the final ‘Global Sovereign Debt’ crisis, which central banks and governments will not be able to tame or control.

The global headlines in the press are presently focused Emerging market chaos, Turkey or China’s Yuan currency falls and the rise of the US$ on the global FX markets. But you have to understand that all of these events have been predicted with clarity for many months and years, not only in my writings and conversations, but more importantly by the serious macro-economic forecasters, traders, cycle analysis and also signalled by world authorities on many occasions (IIF – Institute for International Finance, BIS – Bank for International Settlements, IMF – International Monetary Fund, World Bank etc…).

Again to understand what is happening today and what is coming in the months and years ahead you have to understand what the drivers are in the first place.

The panacea by world monetary authorities to the GFC ( Global Financial Crisis ) of 2007 to ‘09 had major long-term negative repercussions which effectively is going to lead into an ever greater crisis which we are now beginning to experience and recognise quite clearly as the ending of the 320-year cycle, which always ends in the ‘perfect storm’ …….

So policy reaction follows with causality, or cause and effect …….

| Official Medicine for GFC | Purpose | Long-term repercussions |

|---|---|---|

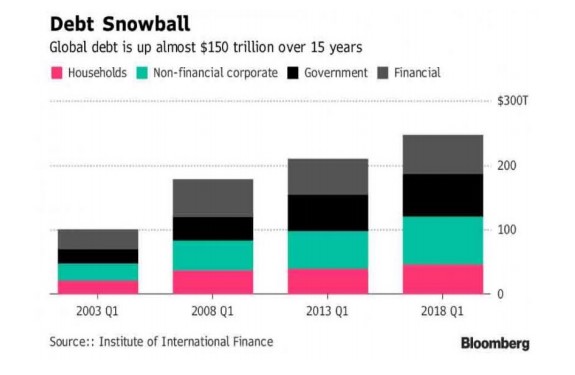

| 1. Global Interest Rates driven to zero bound territory globally | An emergency policy to reinvigorate debt expansion and leverage to drive growth and exit recession / depression | Global debt has expanded to over 255 Trillion US$ globally (319% of GDP). End of 2007 during GFC it was 149 Trillion (276% of GDP). Reaching mathematically unsustainable levels! |

| 2. Global Interest Rate falls lead by the USA | To save their system | USA Carry-Trade started to built globally, morphing into present day and recorded by the BIS to be as large as 20 Trillion USS Carry-Trade unwinds are always disastrous – see 1997’98 Asian crisis (Yen carry trade unwind) |

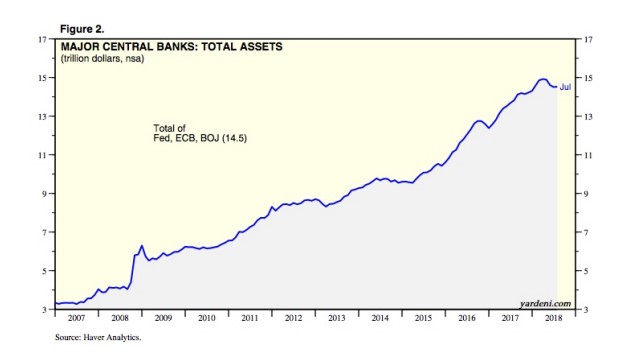

| 3. US authorities instigated QE (large increase in money supply) from 2008 | To re-liquidate banks balance sheets and deliver them the cash ammunition to be able to lend and predominately invest in asset markets to drive stock markets higher. | This has lead into bubbles in prime housing markets globally; longest recorded expansion in USA stock market valuations in history is upon us. FED balance sheet expanded by 550% Bubbles always burst! |

| 4. Sovereign government balance sheet ‘bail-out’ of banks | To save banking system from complete failure | Sovereign balance sheets are now in extreme stress, USA sovereign debt is presently 104% of GDP and expanding close to 4% a year, not including unfunded liabilities and off-balance sheet items which equates to over 365% of GDP. Sovereign Balance Sheet Crisis realisation is upon us |

| 5. Sovereign government balance sheet “bail-out” of banks | To save banking system fromcomplete failuree | Due to the size of debt sitting on sovereign country balance sheets, “bail-in” policy was made law, bank depositor monies are (and going to be) taken in individual bank balance sheet crisis as the individual countries can no longer afford to bailout banks. Depositors money in banks at severe risk !! |

Global Central Banks Leverage Themselves to Extremes

Global Debt Expansion Mathematically Compounding Out of Control

(non-inclusive of shadow-banking debt or un-funded liabilities)

How is all of this likely going to play out ?

US$ rises on global markets – 2. Global Interest Rate falls lead by the USA – Which instigated the largest carry-trade ever historically recorded in world markets. Effectively the world borrowed in US$ from year 2009 to fund the growth expansion in their home countries (converting the US$ borrowed on international markets into their own domestic currency), in the knowledge USA interest rates where near zero and would remain so for an extreme extended period and the US authorities supported a soft US$ currency stance.

Now…. The USA is experiencing a debt-leverage supported GDP expansion and employment growth and hence raising interest rates and also instigating QT (Quantitative Tightening) which is a shrinking of the money supply, this is compounding the debt stress on the likes of Turkey who suffers from a Balance of Payments deficit imbalance (a situation in which imports of goods, services, investment income and transfers are exceeded by the exports of goods, services, investment income and transfers – more outgoings then income), in fact its reported over 30 countries globally are suffering from severe imbalances.

The higher the US$ on world market the worst it gets, its like a snowball effect. The higher the US$ the more the world has to buy US$ to unwind their US$ debt exposure (20 trillion US$ has to be bought to fully unwind).

The US$ is going to continue to rise on FX markets, compounding the global debt crisis and pushing emerging markets into crisis, currency collapses, currency induced domestic high inflation, banking crisis etc..

I wrote about this phenomenon in March of 2015 predicting the eventual rise of the US$ and why this was going to be the case, little did I know at that time the carry-trade would continue to expand into a grotesque 20 trillion US$ monster.

https://www.indigopreciousmetals.com/news/carry-trade/

The US$ will be the final domino to fall.

Europe is a dead man walking – Will Italy be the final nail in the coffin ?

In mid-August the chairman of Italy’s budget committee stated with frightening honesty that the country’s bond market will spin out control as soon as the European Central Bank stops buying its sovereign debt – which the ECB has already pre-announced that it will halve purchases of euro-zone bonds to €15bn (£13bn) a month in October, and will stop altogether at the end of this year 2018.

He goes on to say …..“The bond spreads will widen dramatically. The whole situation is unsustainable without an ECB guarantee, and the eurozone will collapse,” said Claudio Borghi.

Understand this is a greater threat to European banks (who are already recorded as completely insolvent) and global finance than little old Turkey or emerging market countries. Italy’s euro-sceptic alliance have stated they would immediately activate its “mini-bot” parallel currency and subvert monetary union from within. The mini-bot is part of their official programme, they propose the restoration of the Medici Florin as the new patriotic coin of Italy rather than suffer the depression of a debt crisis under the strict constraints of Europes policy makers.

Italy’s profligate government finances and debt-soaked banks of the eurozone’s third-largest economy poses the largest imminent threats to global financial markets. The increasingly populist Italian government is locked in a political battle with somewhat slightly more solvent EU members, chiefly Germany, a conflict that’s in October.

Italy has government debts of €2.1 trillion (£1.9 trillion), equivalent to a massive 130pc of national income. The economy has barely grown since the single currency was launched in 1999. Unable to devalue, the legacy of a triple-dip recession and stagnant investment has saddled Italian banks with an estimated €225bn of non-performing loans – roughly a quarter of the eurozone’s entire Non Performing Loan stockpile.

Local banks themselves hold more than €400bn euros of local sovereign debt – so government and the financial sector are locked in a ruinous vortex, ending all hope of a domestic bank bailout – please note the risks of bail-in policy here.

Plus, Italy owes an additional €400bn within the European Central Bank’s “Target 2” mechanism –

mainly to Germany. “It is not only Italy that will be in trouble. Who is going to buy a 10-year Portuguese bond with a lower yield than a US Treasury, when there is nothing standing behind Portugal ?”

Currency weakness derived inflation is feeding into the system and will only rise, thus compounding the debt mountain problems.

Housing markets – Are now cracking globally

Be it in London, Singapore, Sydney and now Hong Kong.

https://www.telegraph.co.uk/business/2018/08/17/buyers-flee-hong-kong-property-credit-crunch-bites/

In a debt crisis interest rates rise substantially and very quickly while the availability of credit dries up, and with the final housing bubbles globally recorded at house-price-to-earnings ratios of all time nosebleed highs mixed with extreme debt leverage (Hong Kong 19 to 1, London 14.5 to 1, Sydney 13 to 1, etc..), the direction of property is clear for all to see, especially considering banks are now unable to continue their debt lending expansion.

Stock markets

As I have said over the last 24 months the US stocks markets are going to benefit from the wall of money being re-directed into the US$, not only from the unwind of the carry-trade but global flows are recognising the change of momentum. Money is simply not going to sit in banks in the USA, it has to go somewhere and US debt markets are not going to be beneficiary.

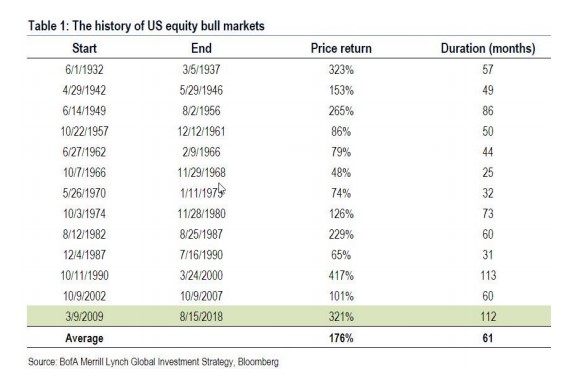

Hence the S&P500 is now recognised as the longest bull market of the last 100 years, all these bull markets ended very badly, however do not mistake me – I am not calling for a USA stock market collapse as this debt crisis is a once in 320-year cycle and hence driven by differing dynamics, but you should be aware of this historical precedent and be warned…..

( Bull markets are recognised as not experiencing any correction greater than 20% ).

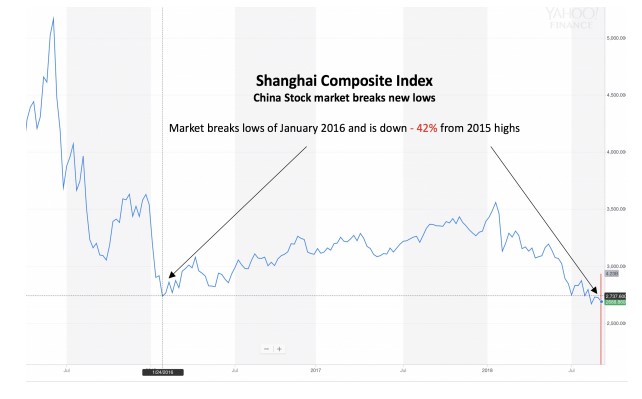

While China’s stock market continues its steady path lower,

Conclusions, with a focus on metals

The US$ will continue to appreciate on world markets, though obviously not in a straight line and with great volatility, but this crisis will culminate in a devastating US$ rally which causes extreme pain to the global borrowers of US$.

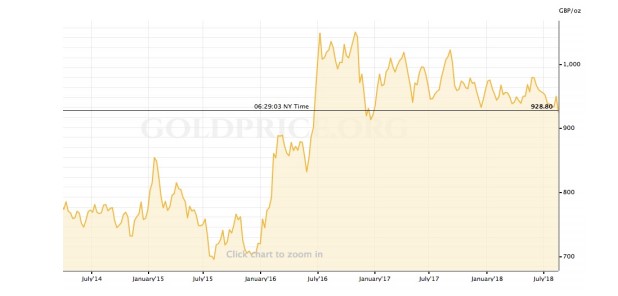

Precious metals – The initial repercussions of this rise in the US$ on FX markets is lower metal prices against US$, although in Sterling, Euros, Yuan or other world currencies the gold price will hold a lot stronger ……

Gold Price Chart versus £ Sterling

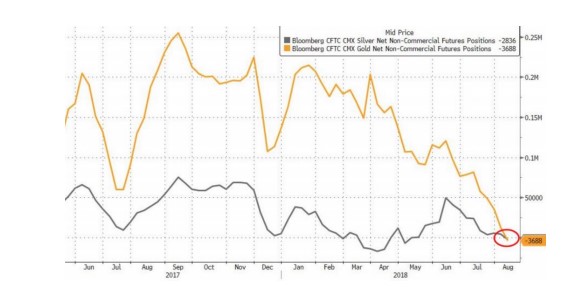

Hedge funds, speculators and traders are leveraging into short gold, silver, platinum against US$ on the futures exchanges to make the most of an opportunity (stronger US$ globally), while capitulation of long positions by investors who do not fully understand the market structure is forcing lower prices, while the banks, central banks continue to accumulate more metal.

In the just released CFTC data a few weeks ago, speculators went net short for the first time since December 2001 when gold was priced at $275 an ounce. It’s tough to find a more contrarian indicator.”

Banks are long silver for the very first in over 24 years on the Comex futures exchange !

Believe it or not this is incredibly bullish within the bigger picture, the whole construct of the futures market is moving to one side of the boat (short gold and long US$), this distortion cannot last and is also pushing silver and platinum well below all-in-sustaining (AISC) cost global production figures, further pushing the global producers to cut back on production due to huge losses and further aggravating the global supply demand physical deficits. Silver is already recording lower global production from last year and over the next 5-years is accepted globally that mine production will experience large falls, while industrial demand is actually growing strongly.

Platinum meanwhile has crossed a line, which is presenting an enormous opportunity – this I will write about in a further email this week.

Once the western sovereign debt crisis starts to be fully recognised, falling debt markets (rising interest rates), vulnerable stock markets, insolvent banking institutions, falling housing markets, collapsing currencies, the wholesale flow of funds into precious metals in physical form for wealth protection will simply be unprecedented and major shortages of said metals will then be recognised.

In fact, paper leverage is recognised at all-time highs, for example the number of “paper” silver ounces traded on the major world silver exchanges divided by the actual world production of silver in ounce is over 180 to 1, gold is over 88 to 1.

Understand what is happening globally to fully comprehend how to protect your wealth in the coming years ahead.

Disclaimers : IPM Group Pte Ltd. 30 Cecil Street, #19-08 Prudential Tower, Singapore, 049712, Company Registration No: 201428070N. All rights reserved. Any reproduction, copying, or redistribution, in whole or in part, is prohibited without written permission from the publisher.

Information contained herein is believed to be reliable, but its accuracy cannot be guaranteed. It is not designed to meet your personal situation – we are not financial advisors, nor do we give personalized advice. The opinions expressed herein are those of the publisher and are subject to change without notice.

It does not consider the particular circumstances, investment objectives and needs for investment of any investor, or purport to be comprehensive or constitute investment advice and should not be relied upon as such. You should consult a financial adviser to help you form your own opinion of the information, and on whether the information is suitable for your individual needs and aims as an investor. You should consult appropriate professional advisers on any legal, taxation and accounting implications before making an investment