“Solving that age-old problem of generating a positive yield from physical metals.”

Auctus Metal Portfolios’ algorithmic models and client returns have been fully audited and verified by a major global auditing house.

Physical Precious Metal Investment Portfolio Management Delivering Superior Returns

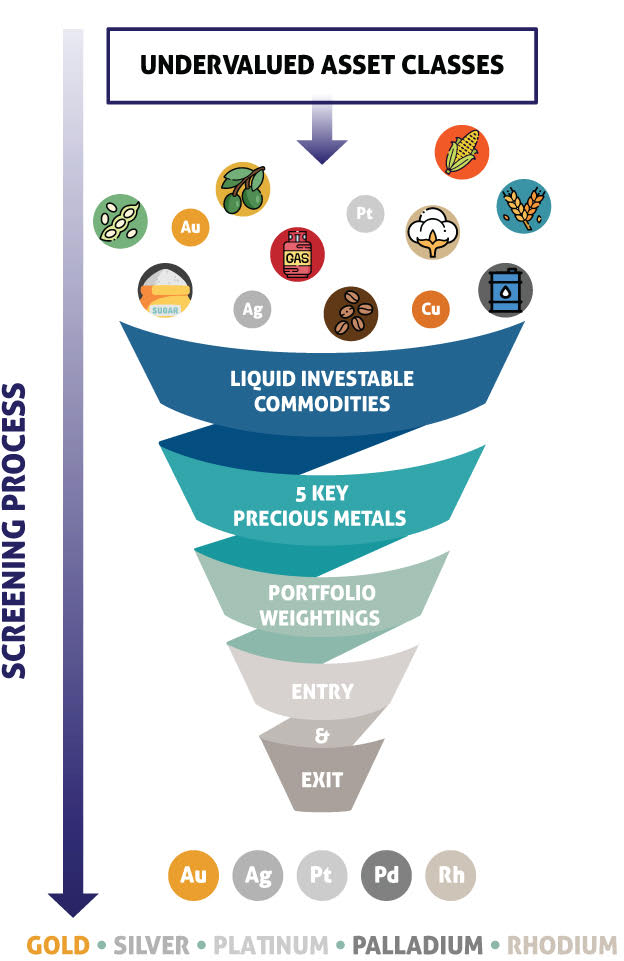

CHOOSING THE RIGHT ASSET CLASS

An investment into physical precious metals should be constructed based on an informed analysis ot the long-term global macro-economic landscape as well as the policy repercussions of the 2007 – 2009 Global Financial Crisis.

- DEPRECIATING PAPER CURRENCIES

Understanding the direct macro-policies of our national governments, treasuries and central banks alongside the officially supported instigation of a speculative and debt leveraged push into paper financial assets and property; supports clear cycle developments and attirms the critical need for a diversification into precious metals and The wider commodity complex at this juncture. - OVERVALUED ASSET CLASSES

An acute awareness of the impact of the ongoing global monetary debasement; coupled with an over-extension in value terms of traditional asset classes including stocks, property and bonds, demands portfolio diversification - GENERATIONAL FORESIGHT

Our in-house research and analysis reveals a severe under-investment within the entire commodity complex and long-term cycles are clearly pointing to a major turning point. Careful portfolio management is critical to preserving wealth and maximizing returns within this cycle.

Our exhaustive, numbers-driven database further enables us to recognise clear seasonal patterns and supply-demand curve pressures, which in turn allows us to provide comprehensive advice to our clients with regards to both entry and exit from Auctus Metal Portfolios.

THE FOCUS – LIQUID INVESTABLE COMMODITIES

Once a clear understanding of the desired asset class is ascertained to fulfil the necessity of diversification, this is then broken down into Precious Metals, Critical Metals, Industrial Metals, Soft Commodities and Energy.

- CYCLES AND SUPPLY-DEMAND DYNAMICS

Extensive analysis of cycle timing, supply-demand curves and the pressure points therein is needed. It was clear that metals were going to lead the charge from 2016, with the overall commodity complex beginning a major trend higher trom 2020 and ultimately targeting 2032.

- LIQUIDITY, STORAGE COSTS, INSURANCE AND AUDIT CONSIDERATIONS

From an investment, high liquidity, low cost storage, insurance, audit and potential for substantial price revaluation standpoint, precious metals are the clear choice for a major portion of one’s overall portfolio at this stage.

THE 5 KEY PRECIOUS METALS

Our selection process for choosing which precise metals to include within our model portfolios, requires a consideration of the following:

- global availability of investment grade bars

- precious metal classification

(denoting global investment demand over and above industrial demand) - liquidity

- ability to function as an un-correlated diversification hedge

- price relevance of each metal over long-term cycle time trames

METAL PORTFOLIO WEIGHTINGS

PROPRIETARY ALGORITHMS

- High Liquidity

Provectus Model 1 - High Growth

Provectus Model 2

Analyse an exhaustive historical database, alongside live market data feeds that are used to identify and re-weight the clients’ vaulted physical precious metal portfolio.

SEASONAL OPPORTUNITIES

A crucial part of our expertise is understanding the opportunities that manifest throughout the year and knowing how best to weight the client’s basket of physical precious metals.

PROCESSING HARD DATA

Our process for weighting client’s metals, utilizes over 55 variables and takes into consideration (for example): historical metal prices ratios • technical and Gann analysis • global supply-demand curves • implied volatility • recognition of ore grade degradation and production costs • forward industrial demand curves • capital flows.

PORTFOLIO COMPOSITION

These algorithmic outputs enable us to recognise distinct changes in price trends and therefore exploit (often severe) pricing anomalies that occur between the 5 inextricably linked precious metals.