USD Comparative Performance of Auctus Metal Portfolios vs. Gold and The Dow Jones Industrial Average

In our attempt to keep you in the loop as to the ongoing performance of your investment into physical precious metals with Auctus Metal Portfolios, we wanted to share with you 3 particular charts indicating recent performance, as well as where we believe ourselves to be in accordance with the cycles.

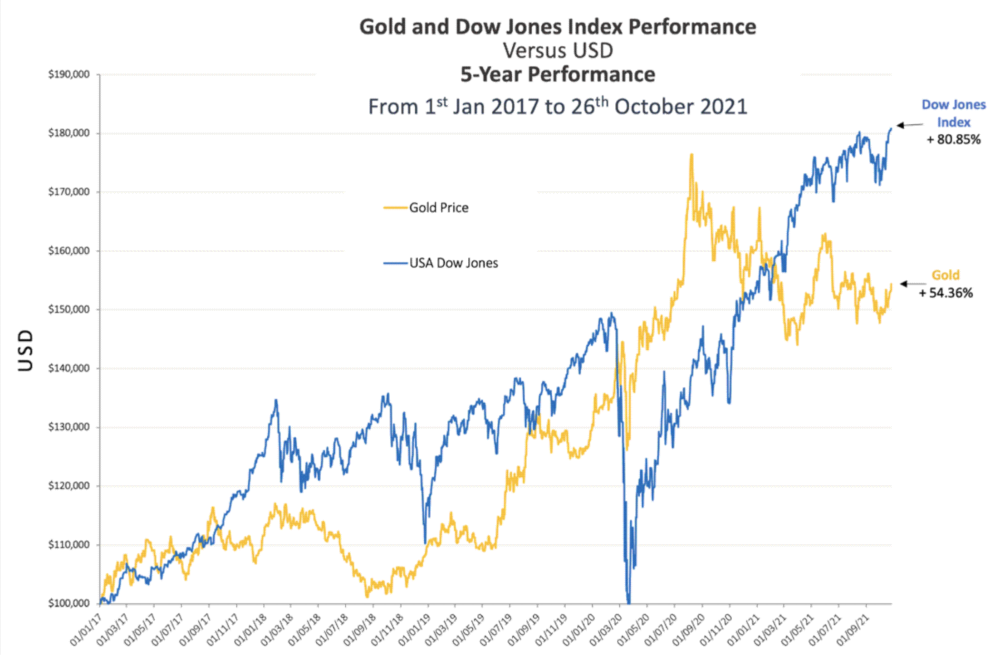

As a starting point, please find below a comparison of Gold vs. The Dow Jones Industrial Average over the past (nearly) 5 years, since 1 January 2017

Whilst Gold is typically accepted as being an asset class that is inversely correlated with respect to equities (hence Gold can serve well as a time-tested diversification tool); this is only true in times of monetary debasement or crisis. It does not hold true within a normal cycle term; and we are most assuredly in an entirely new territory.

Gold has also demonstrated time and time again that it has outperformed in periods of post-crash recovery; as can be seen in the period immediately following the Covid-19 induced crash of March 2020.

Gold is typically seen as a form of portfolio insurance and it’s weighting within a diversified portfolio is usually based upon perceived market conditions. With so much uncertainty in the markets presently, a growing proportion of investors are taking a little more risk off the table and ramping up their ‘insurance policies’ for the purpose of preserving the wealth that they have successfully accumulated.

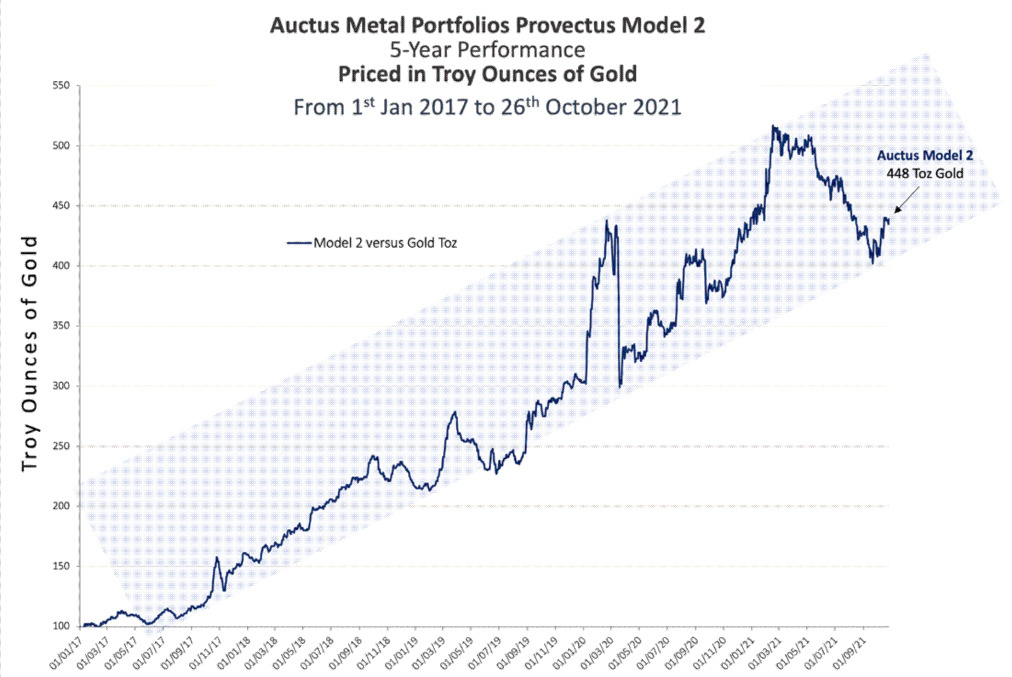

The main frustration investors have with Gold is that it is a negatively yielding asset. There are typically no dividend or rental returns and physical Gold incurs both annual vaulting and insurance charges; and so investors rely solely upon capital gains for growth. The fundamental concept behind Auctus Metal Portfolios [the Latin Definition of Auctus is: To Make Grow | Enlarge | Increase | For Prosperity] was to generate a yield from one’s Gold holdings, by taking advantage of volatility, market analysis and pricing anomalies within the precious metals group to increase one’s total Gold holdings.

Below is a chart detailing the performance of Auctus Metal Portfolios Priced in Gold over the past 5 years:

As can easily be seen, if you had converted 100oz of Gold 5 years ago to Auctus Metal Portfolios, you would today have just shy of 450oz of Gold, and therefore have generated a very impressive yield on your original Gold holding.

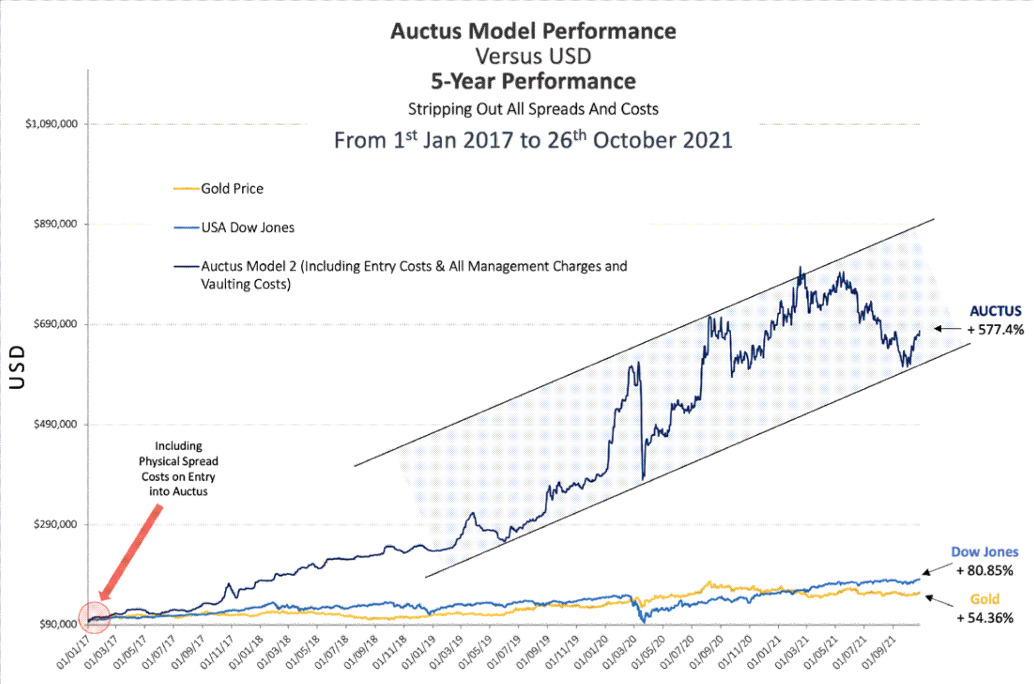

By translating this performance back into FIAT currency, you can see on the next page the USD comparative performance of Auctus Metal Portfolios vs. Gold and The Dow Jones Industrial Average:

It is clear for all to see that precious metals have underperformed over the last 6 months; driven as a result of numerous and differing factors including:

1. Following another very strong year in 2020 into the end of Q1 of 2021, the monetary metals required technical price back-filling and consolidation after the substantial price rises.

2. The price of Platinum, which represents nearly two thirds of our client’s investments with Auctus Metal Portfolios, was negatively affected by an unpredictable ‘exogenous shock’, being the global chip shortage in 2021. This has in turn, caused a sharp slowdown in the manufacturing of vehicles which require loadings

of Platinum within their catalytic converter so as to comply with ever-restrictive global pollution controls and emissions standards.

3. Global investors were falsely led to believe that we had entered a new growth stage of the overall economic cycle; thus ignoring the overriding negative economic fundamentals. We are in fact, at the end of a major economic cycle and despite this, investors have continued blindly buying into stock and property markets.

Looking at the longer-term trading band, we’re confident that we have clearly bounced off that lower range of the band and we will start to see significant improvements in performance over the next couple of months and years.

It is an unprecedented time now for the markets with uncertainty permeating at all-time highs. The fundamental ethos of maintaining a certain exposure to a positive yielding store of wealth within your portfolio has never been more prudent as it is today. Auctus Metal Portfolios has always been developed as a longer time frame investment (the historical back-dated performance of our algorithmic models is quite extraordinary) and we’re confident we’ve ridden out the shorter-term downside volatility and are back on track to seeing our outsized and historical long-term performance levels.