David Mitchell explores why monetary precious metals have lagged behind several other asset classes in 2021.

2021 has most certainly been an extremely disappointing year for precious metals to date (in context Silver did rally by 2.6X and Platinum by 2.4X between March 2020 and Feb 2021), but do we really need to be worried and what’s next for global asset markets? Every other asset class has appreciated thus far in 2021 including property,stocks and crypto and importantly the entire commodity sector (oil, gas, copper,grain, timber etc..) has also enjoyed significant price appreciation. Commodities have clearly entered into the early stages of a new commodity super-cycle or bull market (as we predicted through many articles that we published over the last few years, pinpointing 2020 – 2021 as the beginning of this aggressive super-cycle.

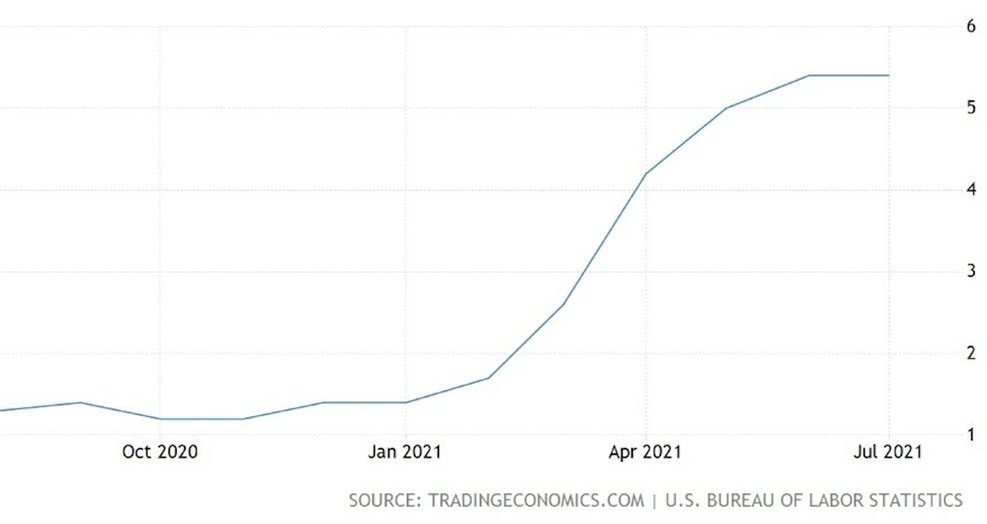

Alongside rising prices we are witnessing enormous bottlenecks in the supply of manufactured products, severe shipping container shortages and unprecedented global chip shortages etc. which is lending support to the vast surge in inflation experienced over the last 12 months. This has been further exacerbated by massive monetary aggregate expansion (see below).

This inflation however is not transitory. It is deep rooted and over the next few quarters we are expecting the data to become even more evident as we head towards the Federal Reserve’s nightmare scenario: Stagflation.

The USA Consumer Price Inflation:

So why have precious metals (monetary metals) in particular,either fallen in price or remained stagnant this year; especially when one considers the dramatic macro fundamentals in Platinum, for example: with critical long-term supply issues growing rapidly alongside exploding demand curves [simple price discovery

cannot ignore this scenario for much longer and the same holds true for Silver].

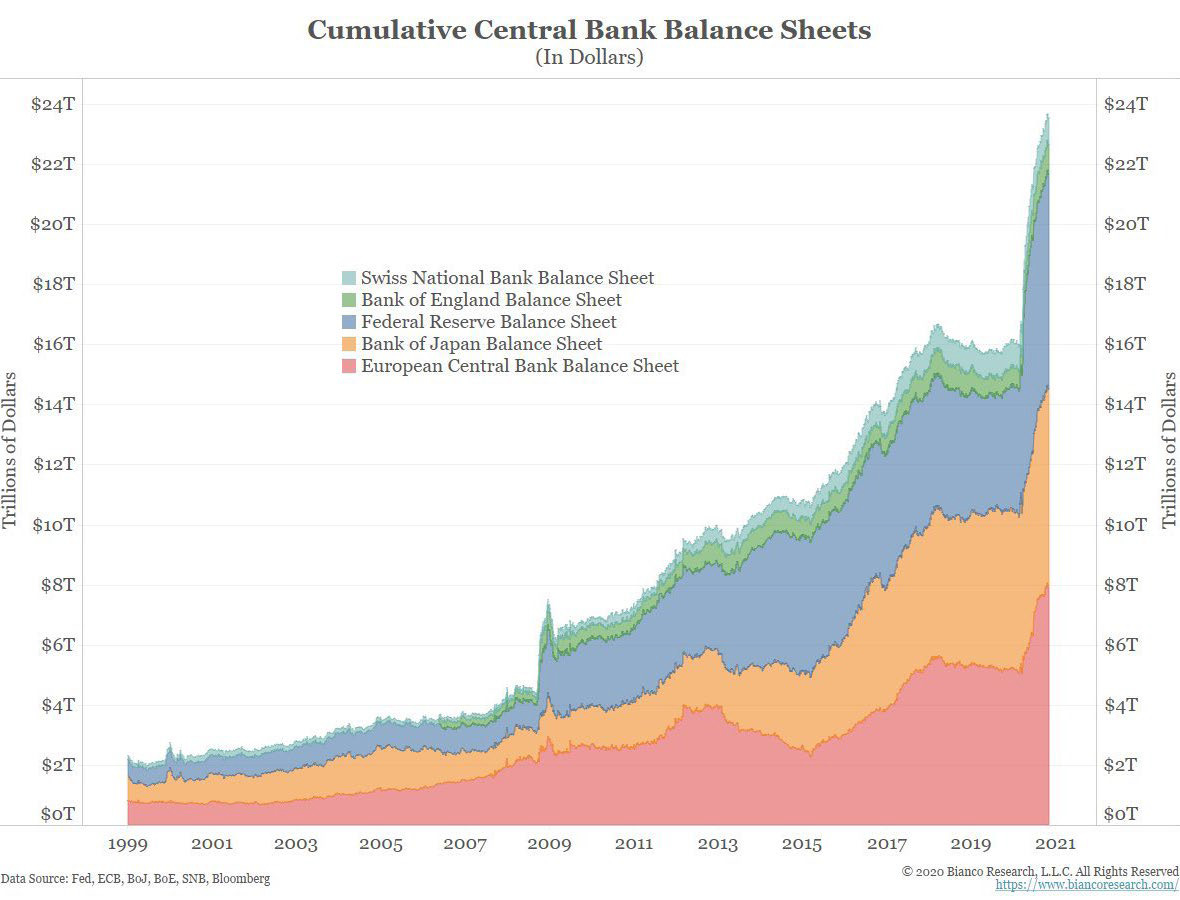

Central banks are still printing money hand over fist in support of government largesse and deficit spending, together with eye-watering global infrastructure plans (including the adoption of zero carbon commitments). It really does seem like only the mad Zimbabweans have beaten them with their money-printing lunacy.

This of course is not conjecture, but can clearly be seen through Central Bank balance sheet expansion; with money printing and the ongoing purchases of government debt and market assets.

This supposed ‘emergency short term policy’ instigated in the Global Financial Crisis (GFC) has now, in effect, been running for over 10 years and counting.

Total Global Debt is expected to hit US$277 trillion by the end of 2021. That’s according to the Institute of International Finance (IIF), but does not include unfunded liabilities or shadow banking debt leverage (which are similarly enormous). This global debt pile has actually grown circa. +6% in the first 8 months of this year demonstrating that debt growth is clearly outpacing economic growth, even with zero percent interest rates. Debt in developed markets is set to hit 432% of Gross Domestic Product (GDP) by the end of 2021!

This calamitous global debt crisis (the largest in recorded macroeconomic history) will have terrible consequences for the global economy over the medium term horizon (to think otherwise is simply naive). It is now mathematically impossible to avoid. Markets are however ignoring this presently; instead choosing to leverage their positioning and driving the aforementioned debt growth into giant housing and stock market bubbles.The thinking, I suspect, is that so long as Central Banks continue to print money and keep control of this contrived ‘house of cards’ then apparently no real problems shall ensue.

People sadly have very short memory spans and it would seem that they have forgotten the numerous market crisis years of ‘97-98, 2000, 2007-2009 and 2012, but without sounding too facetious, why would they believe anything other than how solid the house of cards is presently!?

Auctus Metal Portfolios – Performance:

We have achieved tremendous returns for our clients since the start of 2016 (which was clearly identified as the commencement of the next major 8.6 year cycle for monetary metals). During this period, we have beaten almost all asset classes in terms of price appreciation performance. Of course nothing ever travels in a straight line and indeed 2021 has demonstrated that the monetary metal prices have necessitated a back-fill and consolidation following the considerable price rises.

It is easy to argue that this actually makes no sense whatsoever and seems to be a complete departure from real world fundamentals including: inflation data, monetary aggregate expansion, monetary debasement and growing civil and political tensions around the world.The markets could also easily argue that price manipulation has been quite apparent, and that we have had a capitulation of precious metal longs, seemingly attracted to invest elsewhere.

To more accurately explain why precious metals have performed poorly in 2021, we have to first understand how and why they move? I wrote the following a few weeks ago in a new section on our website ‘Which Precious Metals Do We Invest In’…

Gold has historically been an incredible holder of purchasing power versus currencies,which consistently lose value over time. The market will highlight that Gold is a reliable hedge against inflation but actually this is not entirely accurate. Between the years 1980 and 2002 we had high compound rates of headline inflation and yet Gold fell in value against currencies for over 20 years, again this can be seen during 2021 with extreme inflation picking up globally and yet Gold has fallen in price. Gold is more accurately a “crisis hedge” and a fantastic holder of purchasing power over very long periods of time.The price of Gold tends to rise very dramatically and corrects when under-priced in times of crisis and hence recognizing where we are within the larger macroeconomic cycle is of paramount importance.

Conclusion:

Around the world, it seems that everyone believes that we have now entered into a new growth stage of the overall economic cycle, purposefully ignoring the plain and simple facts we are at the end of a major economic cycle which is a blow-off top based off the world’s massive money printing and aggregate expansion with enormous debt leverage.It is this “hopeful thinking” that has led investors to believe that they do not require the safety of precious metals; as the world’s economic outlook continues to be so rosy and bright.

They are simply ignoring the extreme and unsupportable valuation metrics of stocks and housing, even though the likes of Buffett, Dalio, Paul Tudor Jones, Kyle Bass, Sam Zell,Mark Mobius etc. are all warning that these markets are perilous and are themselves actively diversifying their portfolios into both metals and commodities.

Our role is to examine the cycles and hard fundamentals. If these factors change and necessitate a rebalancing of our overall portfolios then we will be sure to advise our clients accordingly, even if this calls for a move out of metals entirely. But, the fundamentals are becoming ever more extreme for a massive revaluation in precious metals (by several multiples at least). This is a big statement and I stand by it. This trend higher in precious metals is simply irreversible.

In our view, diversification across your total portfolio is essential and based on the significant supply-demand issues, absolute valuation metrics and diversification metrics, this clearly points towards the commodity complex led by the monetary metals when using multiple and varying market analysis.

Definition: Asset market diversification is the process of allocating capital in a way that reduces the exposure to any one particular asset class sector or risk. A common path towards diversification is to reduce risk or volatility by investing in a variety of assets and sectors.

Many institutions are now diversifying their balance sheets, while at the same time we are hearing of many individuals moving in the opposite direction and leveraging into housing and the stock markets at these elevated and extreme levels.

Palantir Technologies for example is the latest company diversifying, and said that they are preparing for another “black swan event” by stockpiling Gold bars. The company spent US$50.7 million this month on Gold.

It is a widely recognised fact that 80% to 90% of market investors either lose or underperform the standard indices because:

1. They do not fully comprehend the enveloping macroeconomic fundamentals, within the larger framework,

2. They only buy an asset when it is rising and invariably when it has already risen a great deal, ignore valuation metrics,

3. They never buy when an asset is on sale and screaming ‘buy’, as they only perceive value when prices are rising.

The likes of Buffett and Dalio get terrifically wealthy by buying on sale and selling when expensive, recognising valuations and understanding the macro case inside-out.

I actually wrote an article (which can be downloaded here) detailing when we can expect the fireworks to start developing and growing rapidly.

Towards the end of this year (2021) and into the beginning of 2022 is when we will start to enter the last 30% of the cycle in precious metals of which historically, 80% to 90% of the overall price revaluation within the cycle will materialize. I believe it is a reliable and accurate report and very worth reading if you haven’t already.

METALS ARE ON SALE at these levels and I am personally buying as much as I can afford on these significant dips. Please note that this is absolutely not a sales pitch, but rather an honest review and analysis of where we stand in the bigger picture and looking out over the next 3 years. Timing has always been more critical than price.

3 September 2021 Update:

Fed Powell’s statement coming out of the Jackson Hole Central Bankers Symposium on 27 August 2021 has now focused the global markets on USA job numbers, especially those released last Friday.

To be clear, the Fed and seemingly the global western Central Banks are now no longer focused on containing inflation, but rather clearly concentrating on job numbers and overall growth patterns. This once again demonstrates (and we have written about this numerous times) politics and modern monetary theory now control monetary policy and not Central Banks. Poor employment numbers would point towards the continued velocity of money printing and monetary aggregate expansion.

The job numbers in the USA came in at +235,000 which seems impressive, but they actually missed the consensus of market expectations of +750,000 and therefore money printing continues!

We also need to mention the situation in China currently: China is in the grip of a ferocious world’s largest financial bubble off the back of record debt and leverage in the Chinese economy. Western policy leaders will continue with their feet on the proverbial ‘money printing pedal’ as they remain extremely nervous about the global reverberations of China’s policy direction.