A correction in the platinum group metal (PGM) prices, in which the palladium and platinum prices fell 10% occured in May and into the first few days of June. According to our research, market commentary and communication with senior traders in London; this occurred as a result of financial institutions and speculative holders of metals taking fright from a perceived slowdown in manufacturing demand and increasing supply coming to the market.

The increase in supply stems from existing stocks of aggregate being pushed through the newly re-built processing plants in South Africa, though this supply had already been factored into the overall supply-demand deficits.

The deceleration in demand is very short-lived however and has been driven as a result of a global shortage of chips crucial to car manufacturing. Cars nowadays cannot be produced without banks of these microchips.

We expected this short term volatility from recent record high price levels and a healthy consolidation period was required. The market however seems to have got carried away with itself whilst ignoring excessively strong fundamentals that will support considerably higher prices in the years ahead.

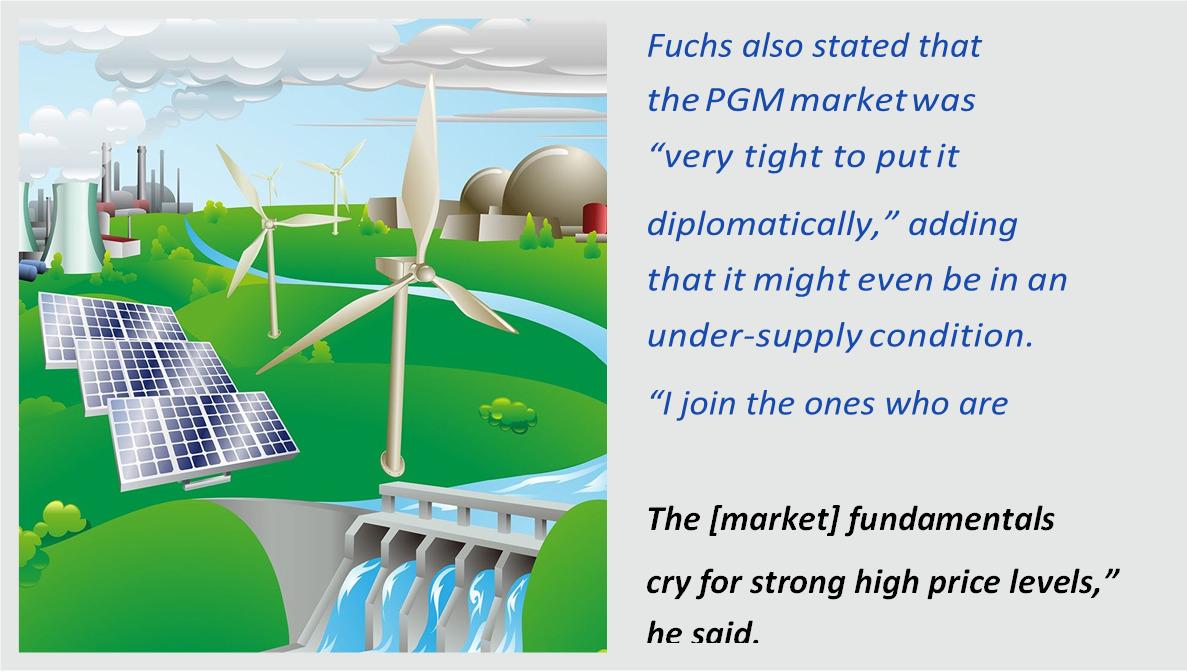

“We have had this huge volatility recently which is not very surprising

given the price level. Purchasers are looking more carefully at PGMs than in recent years and any small news has an impact on the volatility,” said Bernhard Fuchs, senior vice president at Umicore.

“The small decline in demand [for PGMs] recently is not as large as the media hype would make it, but it is clearly due to the chip shortage, and nothing else.”

“Without the right chips, they could not produce the cars and they had to halt production lines, and this boils down to less catalytic converters, and this boils down to a little bit less demand,” said Fuchs.

The shortage of electronic chips was partly a function of the rebound in economic activity following the Covid-19 shutdowns of last year. The palladium price has partially recovered its earlier losses rising 4% from the lows, while platinum (with the strongest fundamentals for higher prices) is still trading at the lows and most certainly a very attractive price entry point.

Reuters for example cited General Motors as saying this week that it was restarting production lines as part availability improved.

Fuchs also said automakers were preparing for the summer shutdown

when European workers take vacation. However, he advised market speculators to resist panic selling. “To those who panicked, I would say calm down. You will be very happy when you still have metal to sell.”

Umicore is a materials handling and recycling company.

Nico Muller, CEO of Impala Platinum, said that market fundamentals “… are going to remain strongly in favour of elevated prices over the next five to seven years”, partly owing to an absence of a supply-side response.

“We are seeing an increasing tightening of emissions in terms of light-duty and heavy-duty [vehicles], and we have not seen a commensurate increase in capital growth owing to a number of structural constraints,” he said. “So don’t see a supply response in the short-term,” he said.

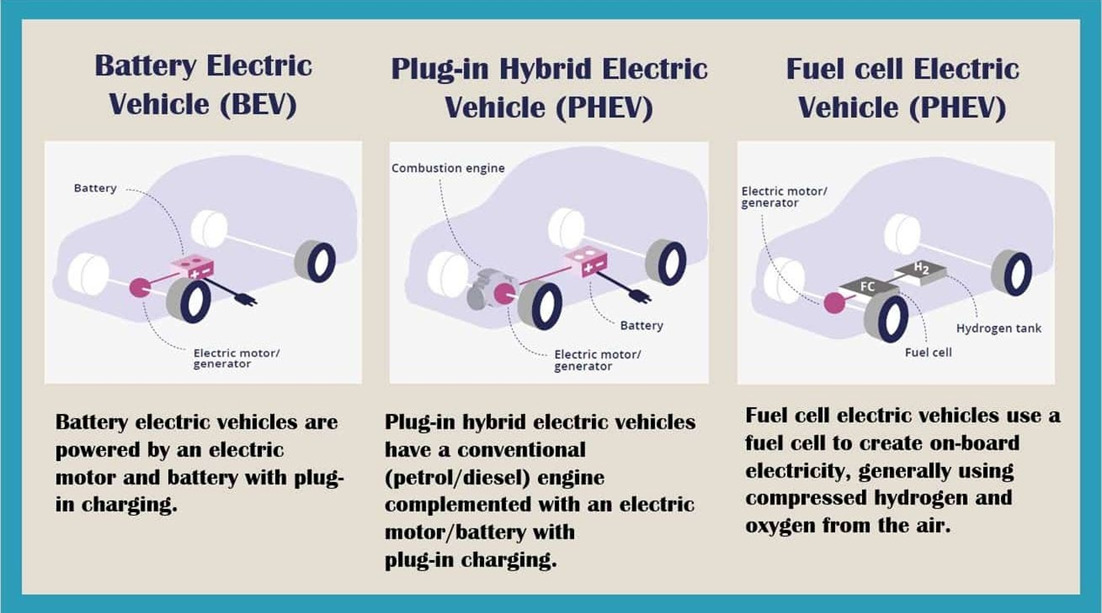

Steve Phiri, CEO of Royal Bafokeng Platinum, commented that the development of battery electric vehicles was unlikely to unseat demand for PGMs in catalytic converters used in the internal combustion engine. “The two will be contemporaneous,” he said.

“BEVs will not be taking over from ICEs but competing side by side,” he said. Governments would be reticent to “kill the economy” by converting to BEVs and would be “shaking the tree” in advancing tighter emissions.

BEV – Battery Electric Vehicle

ICE – Internal Combustion Engine (Demands Platinum, Palladium, Rhodium) HEVC – Hybrid Electric Vehicles Controller – Combustion Engine Plus Electric (Demands Platinum, Palladium, Rhodium)

FCEV – Hydrogen Fuel Cell Electric Vehicle (Demands Platinum & Iridium)

The unions and the struggling power utility Eskom failed to reach a wage agreement yet again at the Central Bargaining Forum. The National Union of Mineworkers (NUM), the National Union of Metalworkers of South Africa (Numsa) and Solidarity have rejected Eskom’s 1.5% salary increase offer and instead demand basic salary increases of 10%, 12% and 9.5% respectively.

Eskom has triggered a dispute process with unions over pay, leaving a government-affiliated mediator to try and forge an agreement to avert potential further disruptions to ongoing power supplies issues (which are critical to mining, especially within superheated magma mines).

Eskom says it doesn’t have the financial muscle to pay for the proposed benefits and salary increases. Eskom is technically insolvent and cannot even pay the interest on its more than R460 (US$36.6) billion of debt.

These negotiations are going to be very difficult, and could result in industrial action. Eskom already cannot meet the current demand for electricity and as a result has introduced Stage 2 load shedding.

Prolonged strike action will very likely put upward pressure on PGM prices.