A shocking picture of above-ground stockpile availability of Platinum has transpired over the last 10 years, which the global research agencies have simply misreported or possibly even misrepresented with regards to the real and accurate picture.

Global research agencies appear to have concluded that ignoring China’s colossal import data of Platinum from their overall reported global supply- demand numbers was important, apparently owing to the fact they could not accurately report on what the Chinese were doing with these enormous Platinum imports.

China does not export industrial grade Platinum, in fact restrictions are in place halting the export of the metal entirely. China has significantly drained global above-ground supplies as these critical metals form part of the national security sovereign stock and provide the building blocks for many modern technologies. In particular, they are used for pollution controls and new energy sources, both of which are essential to sovereign national security and economic growth.

Our main focus has always been accurately forecasting how the relationship between global platinum imports and exports impacts above-ground stocks and the corresponding strain placed on future prices.

Stock = (Imports – Demand) – Exports

We have pushed forward many detailed research pieces pinpointing the severe risks and downgrades on the supply-side of the Platinum equation and at long last the research agencies are now picking up on this situation, having previously

ignored this critical part of the equation (better late than never I guess).

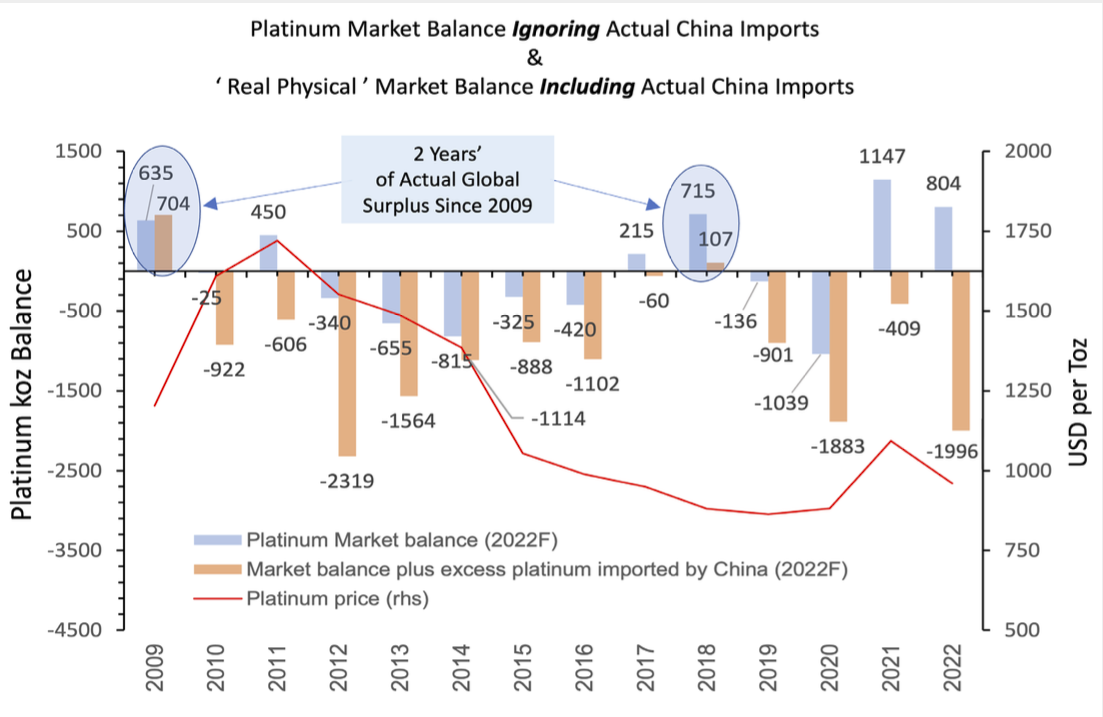

Various research agencies have reported a surplus with regards to the supply- demand data for Platinum over the years, however this is simply not the case whatsoever.

The blue bars below highlight the supply-demand numbers pushed out by many of the research agencies. However, if you include the all-important Platinum import data into China (which is not being re-exported out of China) the global supply-demand picture radically changes.

See the orange bars below to get the accurate overview for the Real Physical Market Balance that includes actual and confirmed China import data:

The readily available above-ground stocks of Platinum in the West that are not locked up by the likes of the USA strategic critical metal inventory of Platinum, have fallen dramatically (we contend that North America will only dip into its above-ground inventories following a significant price increase).

The likes of CPM group and SFA Oxford make a viable case for strategic above-ground stockpile builds, however they completely fail to recognise what is available to market demand, i.e. liquid available stock; and this has been shrinking very quickly!

WPIC noted in March 2022, “..it certainly looks like that with elevated lease rates, and the reduction in NYMEX stocks suggests that China will continue to import more than it uses. A very big driver that puts a ‘bit of a contradiction’ into a market that’s in massive surplus, yet the market is tight.’’ – Editor Note: Hard empirical data confirms that Platinum is ‘not’ in surplus – but an enormous deficit!

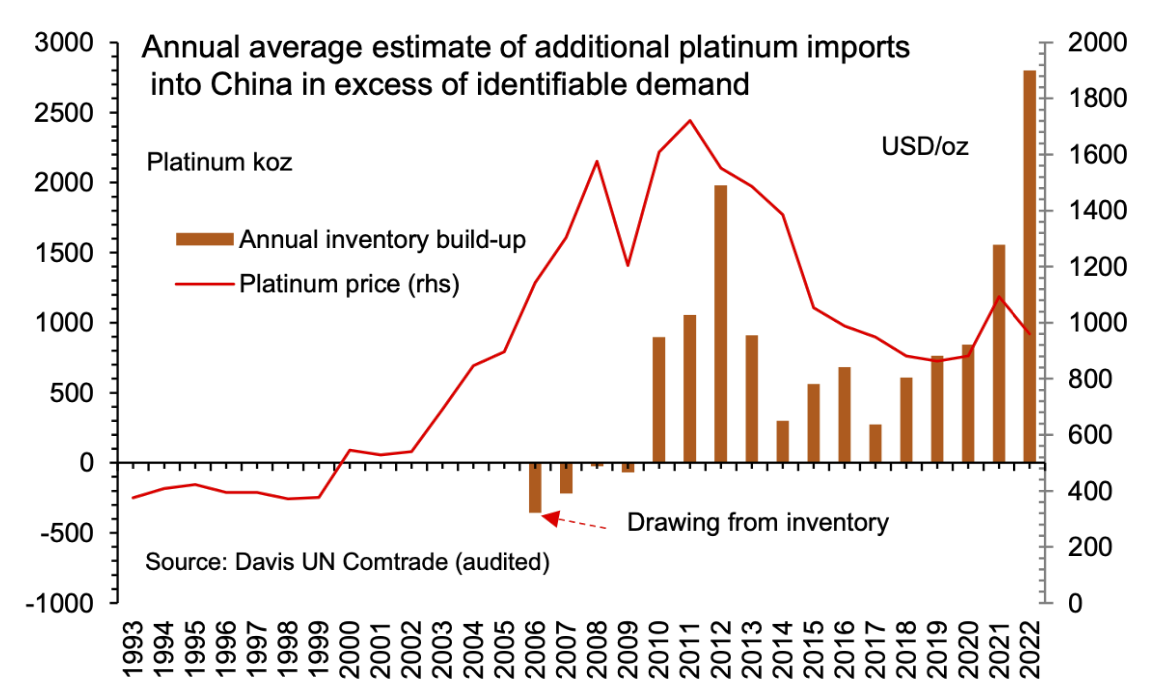

China has obviously built up stockpiles of Platinum over and above recognised industrial end usage (see chart below), but again, this stock is unavailable to the rest of the world.

What all research agencies are now openly recognising is that Platinum in 2023 (even ignoring China’s import data) is heading into a deficit as a result of the rapidly increasing industrial demand curve, and they are forecasting deficits every year thereafter into at least 2032.

This is going to have a major and very positive impact on the price of Platinum moving forwards.

Auctus Metal Portfolios Pte Ltd

Company Registration: 201828518M, 23 Amoy Street, Singapore 069858