The Final Washout Before the Major Multi-Year Rally – by David. J Mitchell

Summary Coverage

- In an outright debt crisis of historical records (this is the worst global debt crisis ever measured), the only mathematical outcome can be an outright currency and monetary debasement.

- As I have asserted many times, our future lies with ‘Inflating’ our way out of this debt crisis rather than ‘Deflating’ our way out.

- Recessions and deflations lead to dramatic increases in debt loads. The Fed’s current monetary (interest rate) tightening policies will have enormous repercussions.

- Global asset markets across every sector are falling hard. However, Gold is holding up extremely well versus a cross section of classes.

- Inflation comes in cycle waves. We have deep-rooted problems and raising interest rates while strangling the economy with monetary contraction and higher taxes is not the solution.

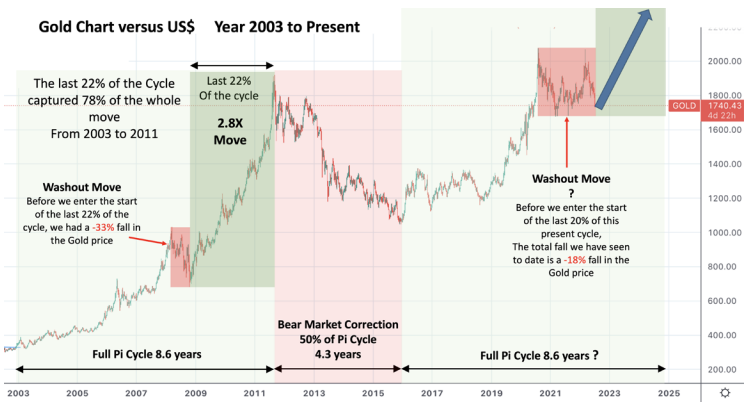

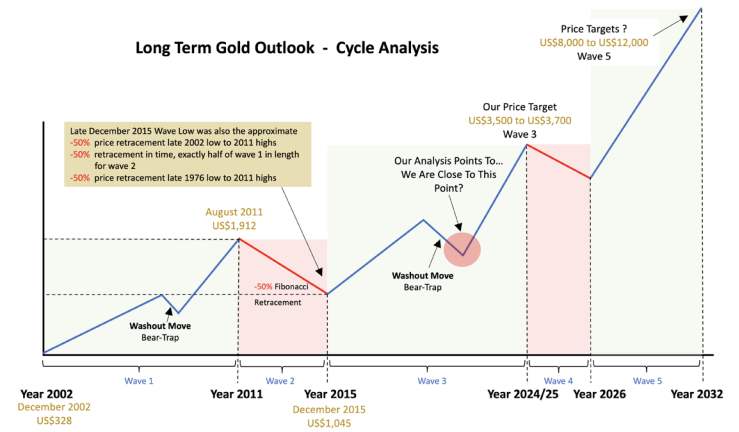

- As we enter the last 20% of the current Gold & precious metals cycle wave, this has historically instigated a bear trap move lower, before a parabolic rally higher.

- A demonstration of the full cycle chart of where we are today and what to expect moving forwards.

- Debt Forgiveness, Debt Monetisation and its repercussions.

- My Conclusion

One really does have to wonder about the Federal Reserve’s competency in understanding what is happening in their very own economy and the consequences of their policies. At its core, is their wholesale belief in Keynesian economics that permits them to ignore monetary metrics. In the late 1990’s they apparently could not anticipate the dot.com bubble and nor could they see the imminent fallout of what would become known as the Global Financial Crisis (GFC). They did not recognise either the housing bubble or the extreme leverage within the system; yet continued to propagate the health of the housing market in 2006. Nor did their Keynesian models identify the explosion of debt growth that followed from 2010 into 2022 and which had been entirely built upon their policies of zero precent rates and money printing largesse. In fact, The Fed was up until very recently still trying to promote high inflation as being transitory!

The Fed is now set on driving the global economy into a steep recession, yet they keep talking about a ‘soft landing’, which is hilarious, if not sad, when considering the global macroeconomic outlook.

Realisation of the damage they have done will come quick and hard.

My best estimation is that by August 2022 they will begin to understand the scale of the damage they have caused and that by early in the 4thQtr 2022 they will already be back-peddling. I strongly suspect that they will pivot their interest rate policies back to lower rates and

continue money printing, while publicly announcing that they have won the inflation battle (which will be entirely untrue).

Yes, inflation will come down from today’s heady levels as a result of the enormous harm inflicted on global demand and asset prices (including commodities). But inflation will very easily re-invigorate itself further down the cycle, especially if Putin turns off the gas and oil supply or dramatically dials down supply; which appears to be increasingly likely in the near-term.

In this report, I will demonstrate where I believe precious metals stand in this present cycle using the charts below. Once investors understand the mathematical circumstances we are in, this matter of fact leads us to only one eventual outcome; and that is an outright currency and monetary debasement crisis. In my opinion this is now wholly irreversible.

With my background as an investment trader within the banking sector and as an asset manager for the last 35 years, it has been very clear to me that the final stages of this growing global debt crisis are fast approaching. The roots of which started several decades ago and which have simply grown at an exponential rate, stemming from the global monetary policy decisions made during the ‘Global Financial Crisis’ (GFC) of 2007-09. Our destiny, and the final resolutions that it brings, is now without question and irrevocable (consequences of global government debt expansion policies leading to Paying the Piper). This is what motivated me to change my own career path over 10 years ago, in order that I may be very closely involved on a full-time basis with the precious metal industry (though I did start investing heavily in metals from 2003).

As I have asserted many times, our future lies with ‘Inflating’ our way out of this debt crisis and not ‘Deflating’ our way out. Simple economic theory and mathematics confirm this outcome as inevitable.

When considering the size of our global debt crisis, the impending recession (the numbers are pointing to the fact that we are already in the recession and its severity is growing), is going to likely lead us into a depression; as negative economic growth will actually inflate our debt plight even further, through two distinct mechanisms:

Firstly, recessions lead to falling growth, a loss of jobs and the sinking of corporate earnings. This causes a significant reduction in tax income into government coffers across all sources. This is then matched at the same time, with rising government outgoings

in the way of welfare support schemes to support their societies, coupled with bail-out programs for failing corporates and financial institutions and household debt increasing in support of families etc. As a result, government deficits and overall debt loads across all sectors increase dramatically, causing the debt growth to spiral, thus further compounding the debt crisis that we are already in.

Secondly, with falling incomes across the board, the serviceability of large debt holdings becomes ever more burdensome, inflating the debt loads as the ratio between debt and the income of the country (and corporate, individual etc..) rises, hence you can never ‘Deflate’ your way out of a debt crisis.

Once you fully comprehend this unequivocal fact, then it’s about recognising the cycles and timings of where we stand today and the psychological standing of our policy leaders in particular. This enables us to grasp how the final outcomes are expressed and importantly, where specifically to invest at this juncture. This is where we see the great opportunity that stems from an outright and enormous monetary (currency) debasement that is required to ‘pay the piper’.

Falling Asset Markets Globally and Precious Metals

Over the last few months, there has been much distress from precious metal investors. Similarly, prospective investors who have been looking at precious metal prices from the side lines, often seem confused and have yet to fully grasp the important role that metals serve within investment portfolios.

On the global stage, we have recently experienced an enormous asset market capitulation across every sector (stocks, bonds, crypto, commodities etc.). This has fed off the back of Central Banks coming under intense political pressure to resolve the runaway inflation monster (despite being directly responsible for its creation in the very first place) by raising interest rates and curbing Quantitative Easing (QE = money printing).

Any political talk of a ‘soft-landing’ is simply nonsense and should be regarded as such. The Central Bankers and monetary policy leaders very clearly understand that they cannot raise interest rates up to the levels of historical precedence; as required to firmly place the inflation genie back into its bottle. As we are in a severe debt crisis, interest rates cannot rise over 3.5% (my best estimate) as the resultant debt serviceability costs will be untenable and the entire debt mountain will start to implode. Hence, they are pushing for outright demand destruction (recessionary forces) instead, so as to pull down the demand side of the equation and the corresponding inflationary pressures.

In effect, their current policy is to destroy both jobs and growth!

It appears that they are playing an enormously dangerous balancing act. A recession (leading into a depression if left unchecked) actually contributes to and further grows the debt loads, which in turn, leads us into outright debt defaults across the board. This will adversely affect the pension fund industries, corporates, banks and individuals alongside the inescapable debt loads at sovereign government level. I believe this would tear societies apart and raise the frequency of extreme civil unrest (the likes of which we are already seeing in Sri Lanka as an example). The consequences of a recession (leading towards a depression) are far more severe than Stagflation and hence inflation will be accepted as the lesser evil moving forwards.

In fact, the European Central Bank (ECB) publicly stated just last week that “Low Inflation is Unlikely to Return”. In ‘real world’ speak that essentially means “Get Used to High Inflation Moving Forwards”. Sadly, they will look to blame some other outlying factor(s) that have caused this (including Covid and The War in Europe), which is nonsense and a clear misdirection for the general public to swallow.

Global cash (currency) liquidity is rising dramatically to record global highs, with the hard selling of all global assets being liquidated directly into cash. This negative yielding currency will then have to be re-invested (put to work), with both money managers and individual investors attempting to recognise what sort of investment environment we are moving into before diversifying out of cash and into hard assets.

So, there is definitely going to be a very big move soon in asset classes as this cash is utilised and put to work. Let’s take a look at what history and the current markets are pointing to…

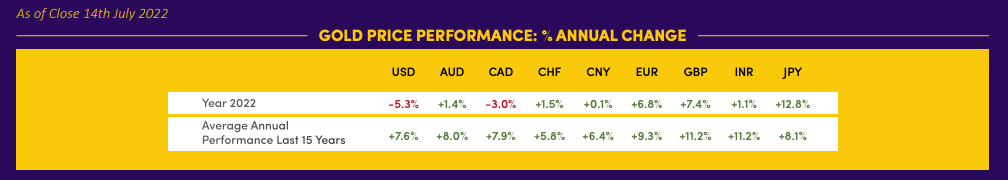

Gold has performed exceptionally well whilst world assets have crumbled around it:

The losses seen in Gold in USD terms for 2022 thus far, have primarily been affected by the sharp rise of the USD on FX Markets (by nearly +12% in 2022) versus the DXY (an index measuring the value of the USD against 6 other major global currencies).

Gold; but especially the other precious metals remain incredibly undervalued at present. The macroeconomic environment will continue to provide great support for the price of Gold as well as Silver, Platinum and the other precious metals. The list of contributing factors that are detailed below are not only obvious, but also ever-expanding:

We have runaway (out-of-control) and deep-rooted inflation on a global scale, historic record negative nominal interest rates, escalating geo-political tensions and deglobalisation movement picking up great momentum along with its many negative repercussions. This is compounded by a global debt crisis of unprecedented metrics, a clear global monetary debasement and weak, ineffectual and unpopular leadership (throughout the West in particular), as we head towards a global food famine in 2023 – escalated by the war in Ukraine. This is further accentuated by the ongoing energy crisis and our proceeding move to green, zerocarbon energy production (supported by enormous investment). This list is non-exhaustive but demonstrates the scale of the problems which all contribute in support of rising precious metal prices on the near horizon.

We then face the global physical supply-demand metrics, particularly for Platinum and Silver that are pointing very clearly to the enlargement of such physical deficits.

We know that the resolution of these physical deficits can only have one possible outcome; and that is price discovery revaluations, which will be needed to eventually help balance the global supplydemand picture.

The FED Pivot & Global Stagflation

There is growing talk of a major Central Bank pivot, led by the USA Federal Reserve. In fact, the USA Bond market is already starting to predict that the Fed will start lowering interest rates and effectively surrender their inflation battle, with US 10-year bond yields moving sharply lower from the recent highs of 3.5% attained in mid-June, to just 2.95% today.

The overriding economic indicators are already leading us straight into a sharp recession, which is continuing to negatively aggravate our global system.

As economic numbers begin to cascade, I anticipate that The Fed will be forced to adopt a 180-degree pivot, as the repercussions of a global recession (leading us into a depression if unchecked) remains untenable, in the face of a global debt crisis.

The major Central Bank turnaround will be lauded in the media as a political victory with the success of winning the inflation battle. However, we will be expected to accept and normalise ourselves to inflation rates of between 3% and 6% for the foreseeable future (though the real inflation rate will undoubtedly be dramatically higher). This will occur alongside weak or negative economic growth rates. Blame will be placed squarely on Putin, post Covid logistic bottle necks, shortages of global essentials, the weather (!) you name it…

Welcome to Stagflation and eventually Hyper-Stagflation.

The USA Federal Reserve has squarely led us into a scenario of capitulating asset markets, and in so doing, they have successfully caused the seismic sell-off across the commodities complex. The GSCI Commodity Index is off -17% from levels seen on 8 June, and is actually -20% lower from the highs seen in March this year.

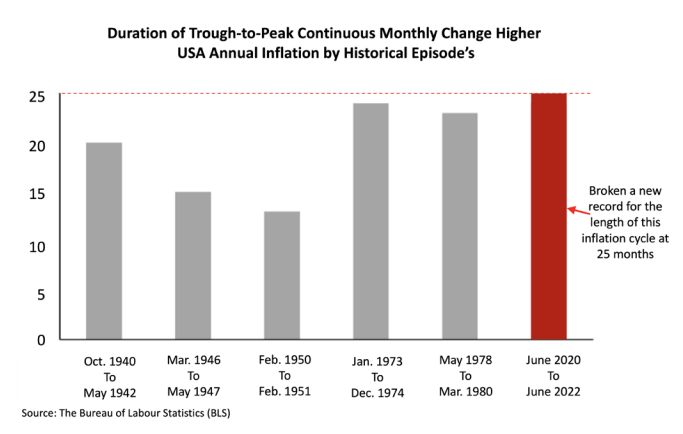

We know that Inflation moves in cycles, but this distinct wave higher has broken all historical records (please see the bar chart below). Standing at 25 months long, I would suggest that the inflation metrics will roll down from here, but our future will continue to revolve around extended periods of sustained high inflation, which will arrive in multiple waves.

The Washout in Prices Before the Multi-Year Rally in Precious Metals

I have concentrated on the overall cycles and recognition of these cycle lengths as a critical blueprint for the layout of my overall investment portfolio. Within the blueprint, we can then constantly analyse and re-analyse macro fundamentals alongside technical analysis and momentum flows, to ensure that the original blueprints stand the test.

The fundamental reasons for owning precious metals at this time are overwhelming as highlighted above; so even though a major asset market sell-off was apparent, I expected the reaction in metals to be relatively muted. This was and continues to be the case in Gold. However, the scale of the sell-offs in Silver and Platinum was unexpected when considering analysis of their individual fundamental drivers (growing production costs, the physical supply-demand picture and macroeconomic outlook).

It appears that the markets have simply capitulated and sold down without any analysis of the true and underlying value metrics. This is beginning to look like a glorified USD trade versus everything else, however such investment trading opportunities of real value, rarely get extended this far.

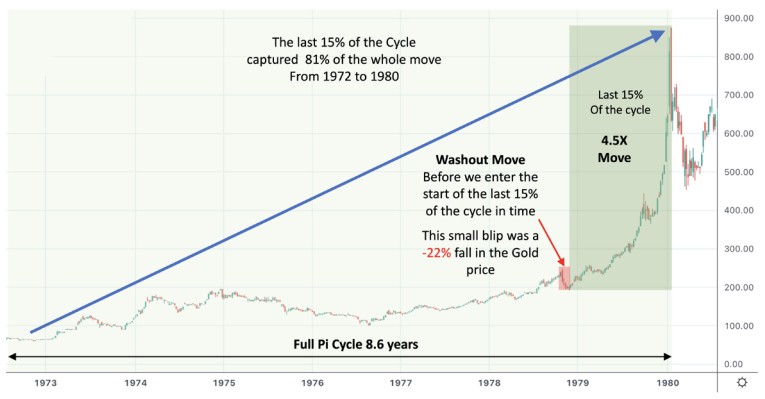

In every major cycle for Gold and the other precious metals, it tends to follow the same roadmap, beginning with a massive washout capitulation; just as they enter the last part of their distinct cycles, before a moon-shot higher, i.e. a super rally. To re-iterate though, I would have thought that the precious metals sell-off in this cycle would have been partially muted by their extremely attractive underlying and bullish fundamentals.

I am concentrating on the historical price of Gold in the charts below, noting that Silver formed a near-identical price chart over the same period, though extended even more dramatically.

Silver

- In March 2008, Silver topped out at US$21.27/oz and sold down to US$8.44/oz by October 2008. This was a -60.3% move lower, before the super rally up to US$49.85/oz (a 5.9X move higher in 2011).

- In 1978, Silver had a smaller washout move of just -12%, before a super rally to US$50/oz into 1980 (representing a 10X move!)

- This time around, Silver topped out in March 2022 at US$26.90/oz and is presently trading at US$18.80 (over a -30% fall).

We are in a very similar situation to the 1970s…

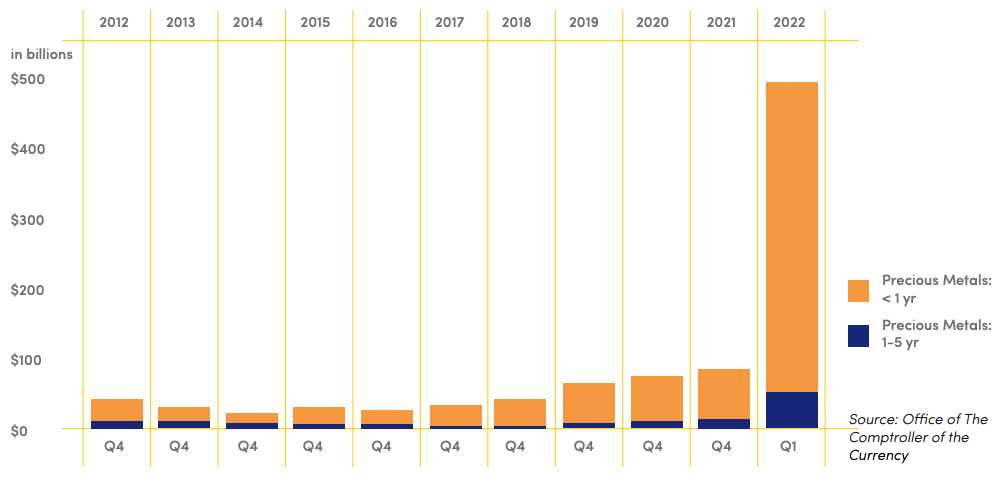

Peter Hambro (a banking ‘insider’ of considerable reputation) recently wrote about the explosion in fractional reserve Gold management through derivatives (and for Silver too) with his claims pointing towards extreme price compression (essentially manipulation), where leveraging of contracts per 1 Toz of Gold are recorded at over 250 to 1. Yes, 250 owners of paper contracts all believe they own the same 1Toz of physical Gold. A blatant Ponzi scheme indeed.

NOTIONAL AMOUNTS OF PRECIOUS METALS DERIVATIVES AT INSURED U.S. COMMERCIAL BANKS AND SAVINGS ASSOCIATIONS

The Paper Gold Emperor’s Clothes

“Straws blowing in the wind are often said to presage great tempests and I believe that this chart shows just such a straw”. “Look at this chart and then go see your bullion trading counterparty and buy some Gold. Then ask for your Gold or Silver or Platinum or Palladium or any other physical store of value and medium of exchange that you have acquired to protect you from the ravages of inflation. For inflation will surely engulf the world when the paper Gold emperor’s clothes are seen for what they really are”. Vladimir Putin and Xi Jinping are among those who know the golden rule: “Whoever has the Gold makes the rules”.

It is crucial for investors to understand that precious metals are an analogue investment vehicle with zero third party liability (if bought and held correctly) versus a sea of overvalued digitized assets with third party liability embedded into them.

Where Does the Final Rally in Precious Metals Take Us?

Considering the breath-taking lengths our policy leaders have been willing to undertake in holding this giant Ponzi-like scheme afloat (by the giant extension of debt growth to keep the motors running, which has in effect pulled forward economic growth that was originally destined for the future) I have had to re-examine my original analysis and blueprint.

Over a decade ago I wrote the blueprint for the basis of my overall cycles analysis (which I have actively and successfully used to help navigate my portfolio through the first 2 waves of this move as well as into this present 3rd wave). In so doing, I have attempted to ascertain an accurate picture of the overall cycles analysis so as to

determine when exactly the final monetary debasement will take place. No one has a crystal ball, but the cycles have proved to be exceptionally accurate indicators time and time again.

The macroeconomic picture and cycles both point to a major 5-wave rally in Gold, or in effect, a 5-wave debasement of the currency system.

The Last Parlour Trick: Debt Forgiveness, Debt Monetisation

The immutable facts that relate to Sovereign country debt are as follows:

- Sovereign defaults are normal (and can be categorised as either (i) a failure of governments paying the interest or capital on an outstanding bond loan, or (ii) forcing a change on the interest payment on the bond or the maturity date of the loan, or (iii) an outright and radical debasement of their currency.

- Defaults are cyclical and inevitable (with few exceptions).

- Defaults can actually be the healthiest remedy to extreme debt loads.

The world is not just slowly drowning in debt, but is rapidly sinking below the waves. Global investors seem to be naively (or indeed unwisely) exposed to this elevated risk and remain seemingly unconcerned.

With zero percent interest rates past us, the monetary environment we face comprises higher inflation expectations as far as the eye can see and new debt issuance suddenly becoming a lot more expensive to manage or service. This will have the effect of causing painful government cuts in funding for infrastructure projects, welfare, education, housing, and pensions.

The relative strength of an economy’s finances can be measured in its total sovereign debt as a percentage of GDP. Debt ratios have exploded above 100% across a spectrum of major economies and sustainability levels are being strained to the extreme.

Central Banks have been accumulating (buying) their own country Sovereign debt (paid for by money printing) and held on to their own books in order to hold rates lower and support the debt markets. This buying spree has broken all of the historical economic record books. The UK’s Bank of England for examples, owns nearly 40% of the total debt of the country and the USA’s Fed owns nearly 35%!

There is however, one last parlour trick left as this debt mountain becomes unmanageable. I believe that there will be one last throw of the dice.

I suspect that there will be a round of debt forgiveness at the Central Bank level and they will be forced to simply write off much of the current debt. This in reality is outright debt monetisation.

The positive side of it is that debt loads and the serviceability of that debt are removed and the debt as a percentage of GDP drops dramatically. But, if this was so appealing or effortless, then why have we not actively been instigating this elusive mistress on a regular basis.

The simple fact is that the negative consequence of this policy is the instigation of a massive downgrade of the currency itself, a huge sovereign currency debasement.

A central bank debt forgiveness would put an almighty fire under the entire portfolio of precious metals.

Conclusion

While we have all suffered a short-term valuation fall (vs the USD) in metals, it is indeed a rare event that investment trading opportunities for purchasing real value become so extended in real undervaluation.

Throughout major bull markets in asset classes, we do see washout capitulations that lend themselves to massive rallies soon thereafter (the slingshot). Weak hands sell assets they do not fully understand and over-extended investors are forced into selling due to margin calls. There is also an element of blind panic selling from the market, that garners momentum of its own. There does come a point where selling becomes exhausted, matching real world

industrial buyers as well as smart money looking for exceptional buying opportunities. This usually precedes an extended and protracted super rally.

Macroeconomic fundamentals are overwhelming in their joint chorus for a currency and monetary debasement which will irrefutably lead to an enormous revaluation of metals. This will be supported alongside growing supply-demand deficits within the precious metals that again holds sway over the price climbs that are now overdue.