Amid economic uncertainty, diversifying a portion of your portfolio with precious metals as a hedge during crises is a wise strategy. There are various ways to gain exposure to precious metals, with two popular options being investing in physical precious metals or through Exchange-Traded Funds (ETFs).

This article delves into the distinctions between these two alternatives.

Physical Precious Metals:

When investing in physical precious metals, several factors need consideration:

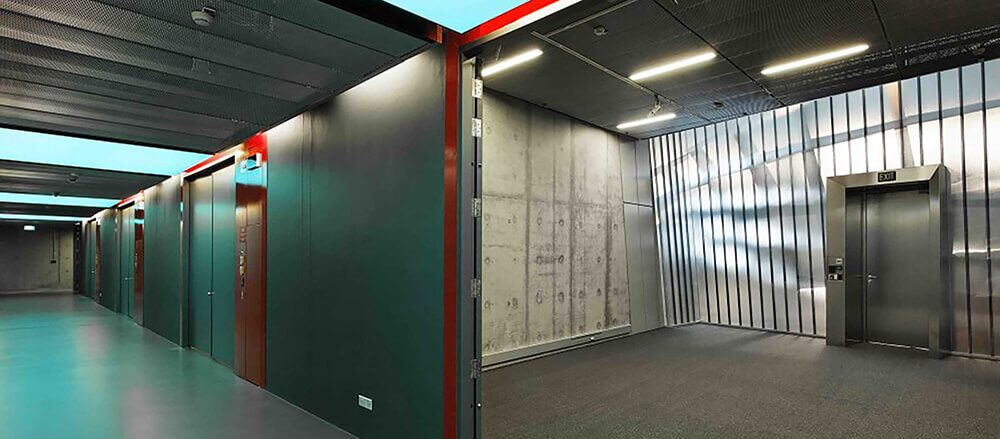

1. Storage:

Determining where to store your metals is crucial. For smaller quantities, storing them at home is an option, but it comes with obvious risks. Larger volumes may necessitate high-security vaults or safe deposit boxes provided by companies that offer storage services, including insurance coverage.

2. Premiums:

Investors typically track precious metal prices online, which are represented as ‘Spot’ or ‘Futures’ prices. However, purchasing physical precious metals incurs a premium, an additional percentage above spot prices. This premium fluctuates based on supply and demand dynamics and includes costs from refineries, logistics, insurance and bullion dealers.

3. Selling:

Bullion dealers globally have contracts with major wholesalers and refineries, facilitating the sale of precious metals to the wholesale market. The buyback price depends on supply and demand dynamics.

Pros:

No counterparty risk

High liquidity

Crisis/inflation hedge

Diversification across different metals

Cons:

No yield

Potential excessive storage fees in the long term

Premiums for physical precious metals

Exchange-Traded Funds (ETFs):

ETFs offer a fund investment allowing investors exposure to specific precious metals. There are physical and commodity ETFs, the former purchasing and storing physical bullion, while the latter tracks metal prices. Both types share the similarity of not providing actual ownership of the metals.

Pros:

Ease of buying & selling

High liquidity

Low spreads

Cons:

Counterparty risk

Limited diversification across different metals

Most ETFs focus on specific precious metals, limiting the ability to select desired diversification across the precious metal sector. Despite being a crisis hedge, ETFs introduce counterparty risks, potentially defeating their intended purpose.

Auctus Metal Portfolios offers a hybrid approach, combining the best qualities of owning both physical precious metals and ETFs. Auctus Metal Portfolios establishes a vaulted account in the investor’s name, ensuring full title ownership of the metals. The portfolio is exclusively invested in physical precious metals, eliminating counterparty risk. Metals are purchased at wholesale prices, minimizing premiums.

Auctus Metal Portfolios partners with both the Gold Bullion Australia Group and IPM Group, ensuring substantial access to year-round liquidity. This hybrid model seamlessly provides investors with the benefits of physical precious metals ownership and liquidity while mitigating some of the drawbacks associated with traditional approaches.

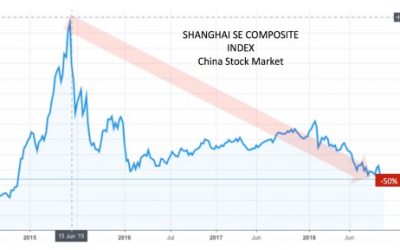

Auctus Metal Portfolios also ensures that each clients’ metal holdings are optimally weighted between the 5 key precious metals: Gold, Silver, Platinum, Palladium and Rhodium and takes advantage of severe pricing anomalies between the metals. The proprietary algorithmic models signal rebalancing opportunities, programmed to ensure a significant outperformance versus a static holding of just one metal.