I have written many times stressing the importance of timing opportunities when investing into precious metals (or any other asset class for that matter) within the greater bull market (revaluations higher) over this very powerful multi-year commodity super-cycle that we are now in.

In fact, I write this same article every year! See last 2 years here and here.

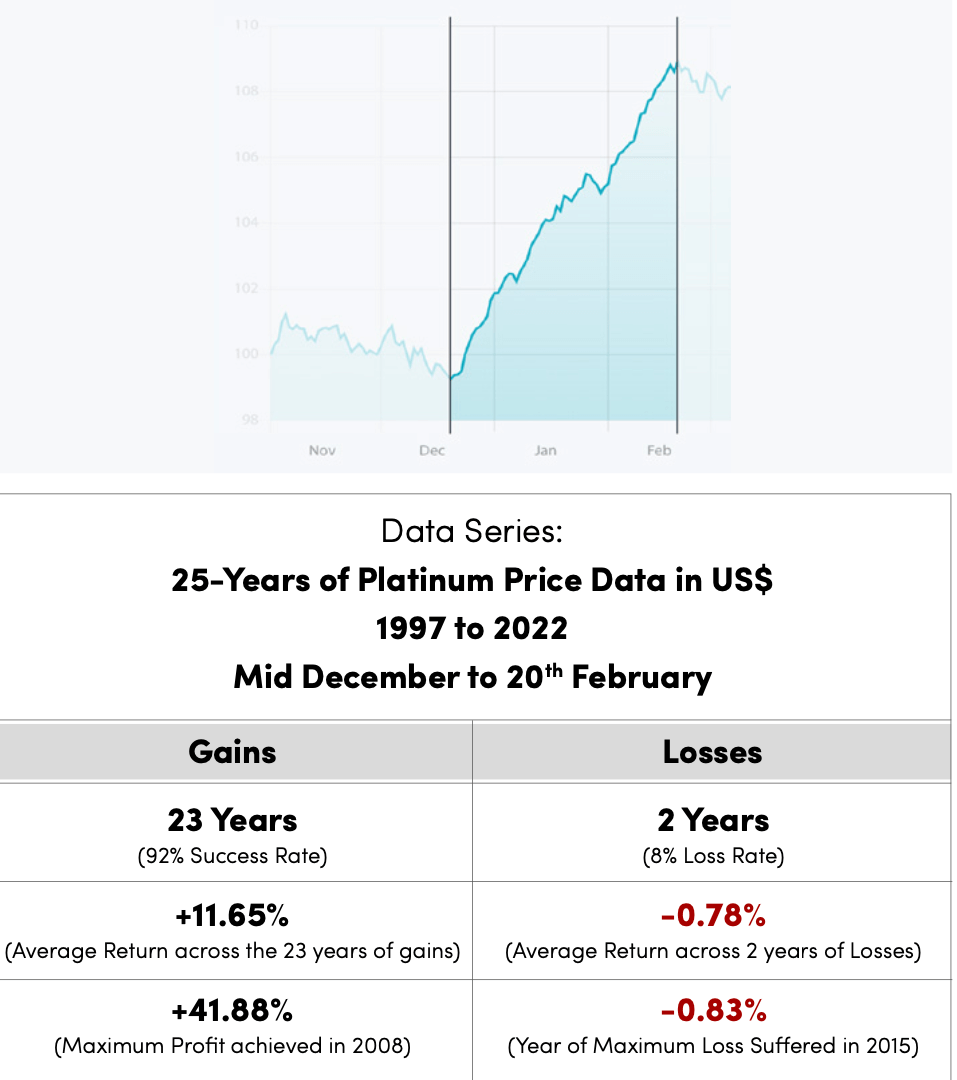

There Is an Historical Optimal Buy Zone Every December

We have again walked directly into the optimal buying opportunity of the year, which is from late November into mid- December, with is almost always followed by very strong moves (sizeable percentages) higher into mid to late February. This is nothing more than a mathematical anomaly that repeats itself consistently, so rather than explaining the fundamentals of how exciting this metal trade is at this time, I will simply concentrate on the pure mathematical analysis of a very long- term series of market data (going back the last 25 years) to extract meaningful statistical patterns and hence a profitable investment edge.

This is very clear linear trend line where the statistical set of data clusters around a straight line.

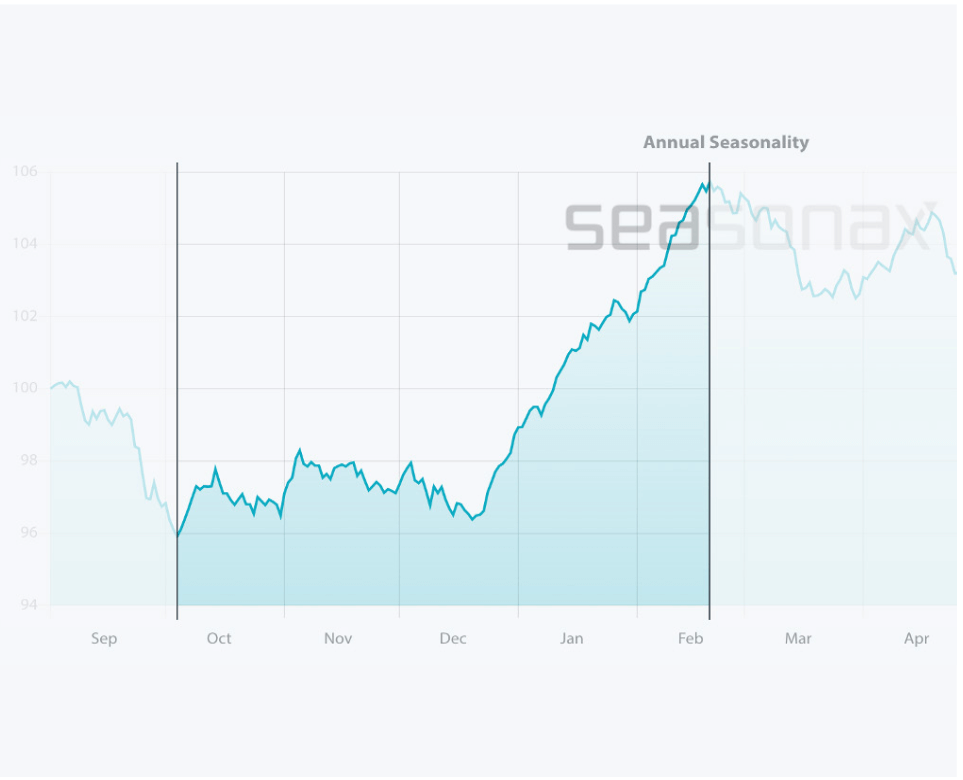

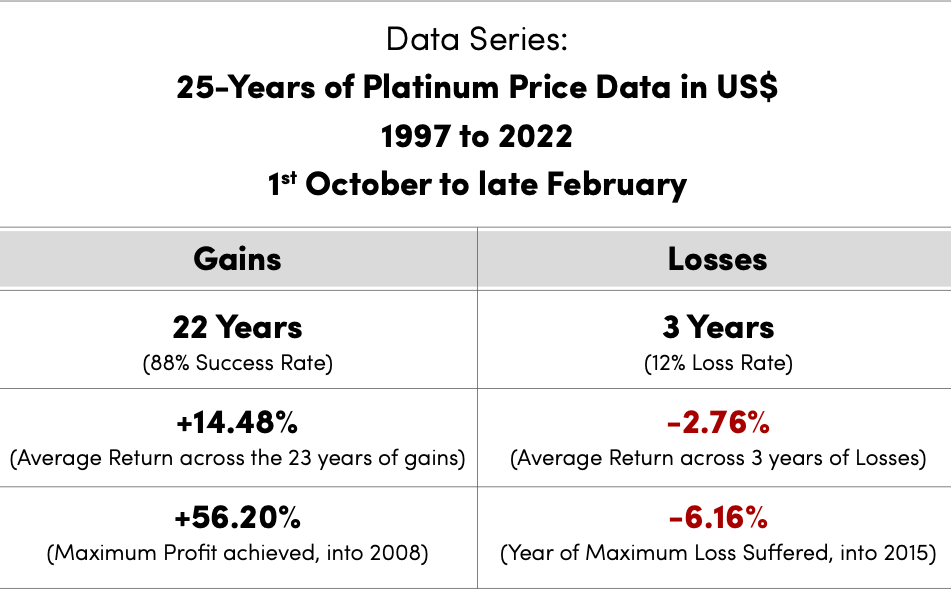

We will look across 2 start dates for this strong seasonal pattern, namely the beginning of October to the end of February, but

let’s start with early December into the end of February….

December into Late February…

Platinum price in US$ Seasonal Data Analysis

These winning probabilities are very stark indeed, it literally does not get any better than this. Whilst most of our clients are indeed looking to hold precious metal investments over a number of years, it is of course always important to ensure a super initial entry point. I shall explain later in this analysis why we get this clear pricing direction every year, but let’s first take a look at the data from October to February:

Beginning of October into Late February

Platinum price in US$ seasonal data analysis

As demonstrated from the pure historical data sets above, that over the last 25 years, there exists an optimal and superior annual buying opportunity in Platinum that has delivered very sizeable percentage gains over a few short months. Even within the larger bear markets that occurred within this time period of 1997 to 2022, this opportunity has held true.

We are firmly in the grip of a very dynamic secular bull market in commodities and within precious metals in particular, with a major recognised shift in the direction of global capital flows. Once invested, clients should firmly stay away from trying to time ongoing rallies and dips. The focus of this year-end opportunity is not only for new investors into precious metals, but also for existing investors to average into a greater allocation of

precious metals within their portfolios.

The idea is to help precious metal investors to understand not only the optimal time period to enter into this investment class, along with a clear overlay of the macroeconomic fundamentals that drive each metal, but to grasp the precise time-frames of the overall expected cycle lengths moving forwards.

We clearly forecast over the next few years, that these revaluations will become a lot more dynamic, as we progress through the latter part of the cycle, as the distinct secular bull market gathers pace.

What Drives This Mathematical Trading Anomaly Every Year?

This is not a case of voodoo science, but simply a real-world logistics situation that is created every year, as financial institutions, international wholesalers, refiners and mints start to de-stock their physical precious metal inventory into the markets towards their end-of-calendar year reporting. As mid- December approaches, they start to do major inventory stock- takes before the end of the calendar year for balance sheet reporting.

As the new year begins dealers, institutions and precious metal wholesalers start the process of re-stocking and building inventory. However, the producers (refiners and mints) do not

start to produce really until the middle to third week of January as they return from their year-end holidays. This causes a backlog of supply and pushes precious metal prices higher along with higher premiums for the physical bullion.

There is also market acceptance that in January 2023, the European and Swiss refiners and mints will very possibly face power restrictions (ongoing energy crisis in Europe) which could lead to a significant reduction in production capacity, which could therefore further aggravate supply in the new year.

Why Invest in Platinum Moving Forwards?

With backwardation curves in Platinum signalling physical shortages at a time of mining ore grade degradation and rising production costs; major capital investment into South African production is required to bring online new ‘reefs’ to supplement the forecast falls in production. However, the very large investment flows that are required, have been discouraged by a number of prevailing factors including enormous political corruption and mismanagement in South Africa including a near-collapse of Eskom (the national utility provider) which has caused rolling blackouts across the country. This dire predicament is only forecast to worsen in the coming years ahead and is leading to growing civil unrest including infrastructure sabotage from commodity stripping.

There has been a noted increase in announcements highlighting falling global mine production in 2022 and this trend has been forecast to continue into 2023 across the 3 main producers of Platinum: South Africa, Russia and Zimbabwe, which together supply roughly 92% of the world’s Platinum market. Pressured by rising global industrial demand curves, significant supply-demand deficits will continue to grow moving forwards as far as the eye can see, and this is further accentuated by the ongoing monetary debasement and impact of real negative nominal yields.

The underlying price of Platinum is the ultimate arbiter, the weighing scales that eventually force supply and demand to balance when out of sync, be it surpluses or in this case severe and growing deficits.

The investment thesis for holding physical Platinum at this time, has never been stronger.

There are exceptional investment opportunities arising across the precious metals space and investors need to move quickly to understand the importance of this. Our team of bullion experts are at hand to provide further advice to clients.

Company Registration: 201828518M

23 Amoy Street, Singapore 069858