The advent of green hydrogen production and fuel cell technology has changed the landscape dramatically and will drive Platinum demand significantly higher from today’s levels.

The global movement for the decarbonisation of energy production and the everincreasing emphasis on pollution controls is causing the landscape to change very quickly indeed. With these newly developed technologies we are going to see a significant spike in demand for particular commodities. As far as precious metals are concerned, we are especially focused on Platinum given the scale of the current investment opportunity.

As we have laid out to our client base and prospective investors before, a perfect investment storm in Platinum is nothing short of spectacular!

Platinum is now being partially substituted for Palladium in catalytic converters used for pollution control due to the growing price differential between these two interchangeable metals. At the same time, shortages of Palladium supply (reported by the car companies themselves) coupled with higher weightings of these metals being demanded in order to meet the increasingly more stringent pollution controls are set to drive Platinum demand higher.

Note: Palladium is more reactive than the other Platinum Group Metals. For example, it is attacked more readily by acids than any of the other Platinum Group Metals. The role of Platinum in catalytic converters is to oxidize carbon monoxide (CO) and hydrocarbons.

From catalytic fabricators alone, they themselves are forecasting Platinum demand to increase from c.150,000oz this year to c. 1,500,000oz in 2025 (a tenfold ncrease)!

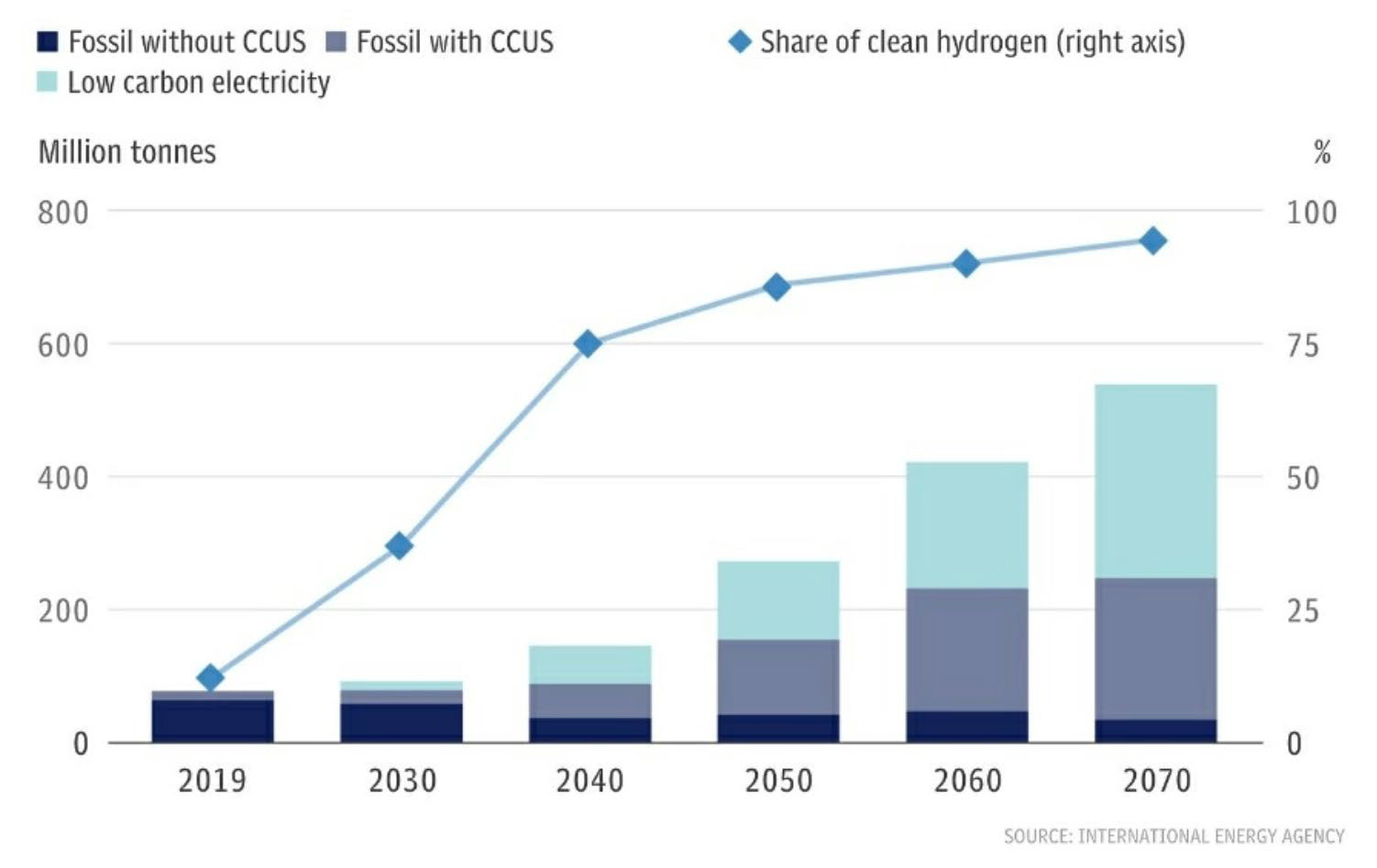

Hydrogen fuel cell and the burgeoning green technology segment will drive Platinum demand significantly higher from today’s levels.

The advent of fuel cell technology has changed the landscape dramatically. There are now two types of proton exchange membrane (PEM) hydrogen fuel cells, which will ultimately drive demand for Platinum.

- The first application, surrounds the PEM fuel cell drive-trains of electric vehicles (EVs),particularly the drivetrains of heavy-duty vehicles – all of which meet the zero-emissions standard.

- The second type of hydrogen fuel cells are called PEM electrolysers, which are used in the production of green hydrogen from solar, wind and hydropower.

This naturally follows the fact that global government investment programs and subsidies are growing; along with demand from major industrial manufacturing onglomerates (car companies, ship builders, energy suppliers and energy storage facilities). These massive global companies in Japan, South Korea, China, Europe, UK and the USA are ploughing into green hydrogen production and hydrogen fuel cells for vehicles in particular.

New Announcement – 16 August, 2021

Billions of pounds are going to be funneled into Hydrogen subsidies as the UK races to hit net zero carbon emissions

Manufacturers are in line to be guaranteed a price for their hydrogen by the Government so they do not have to sell to consumers at a loss, under plans unveiled in consultation papers last week.

The subsidy is expected to be funded through either higher bills or with money from the public purse.

The Government’s strategy published today says that hydrogen could meet 20-35% of the UK’s energy demand by 2050, compared to the negligible amount (currently close to zero percent) and it wants the UK to be producing 5GW by 2030.

Note: CCUS – Carbon Capture, Utilisation and Storage, is an important emissions reduction technology that can be applied across the energy system.

Officials claim this could create more than 9,000 UK jobs and unlock £4bn in investment by 2030, potentially rising to 100,000 jobs by 2050.

The Government says that about 45TWh of UK buildings’ heating might be supplied by hydrogen in 2035. Currently, about 434TWh of energy is used each year to heat UK homes.

Major energy companies such as BP, Shell and Scottish Power are all planning investment in hydrogen and projects could get the go-ahead under the right investment conditions.

In the UK Hydrogen Strategy – August 2021

The role of hydrogen in meeting net zero carbon emissions

Analysis by BEIS suggests 250-460TWh of hydrogen could be needed in 2050, making up 20 – 35% of the UK’s final energy consumption. The size of the hydrogen economy in 2050 will depend on a number of factors – including the cost and availability of hydrogen and hydrogen-using technology relative to alternatives, such as electrification, biomass and use of CCUS.

Nonetheless, there is consensus from the Climate Change Committee (CCC) and others,that we will need significant amounts of low carbon (green) hydrogen on the system by 2050.