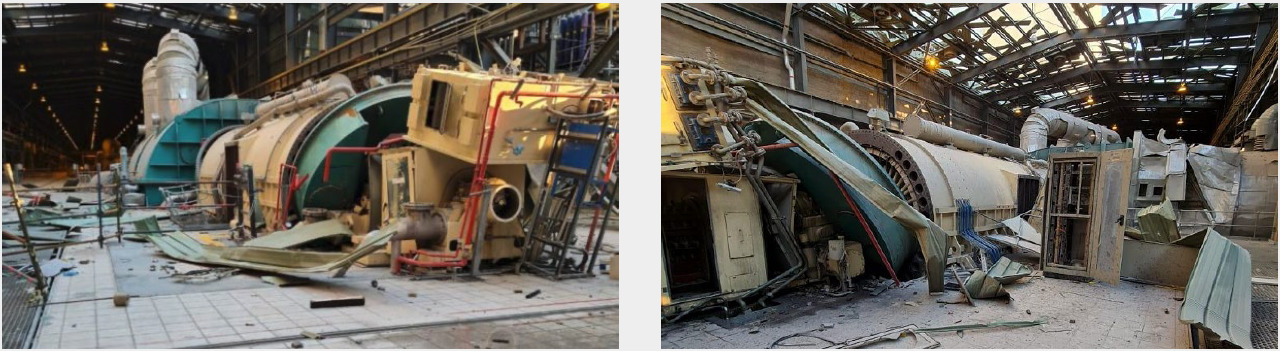

On Sunday 8 August, there was a considerable explosion at Eskom’s Medupi Power Station (the world’s largest and most expensive coal powered generator) which has caused serious damage.

It seems that disasters and catastrophe are never-ending within Eskom’s operations.

A considerable explosion occurred on Sunday 8 August at Eskom’s Medupi power station (the world’s largest coal powered generator) less than a week after Eskom announced that the power station had reached commercial operation status!

Medupi power station together with Kusile power station, two mega coal-fired plants with an output of 4.8GW each, were commissioned to be built in 2007. Eskom said at that time that Medupi and Kusile will be completed by 2015 and will play an important role in solving South Africa’s energy challenges. The construction of these plants has been plagued by a myriad of delays, spiraling costs and highly publicized corruption scandals. Medupi’s completion date was extended to 2021, with Kusile expected to be completed in 2025.

Now seriously damaged, Medupi is not expected to be repaired within 2 years and will cost a further Rand 2bn to Rand 4bn.

Medupi and Kusile are the biggest dry-cooled power stations in the world and most expensive ever constructed, taking some 18 years to build. This recent explosion at Medupi is not only a isaster for Eskom but also for South Africa.

Electricity Supply in South Africa Facing Considerable Constraints – Critical Impact on PGM Production Expected After Medupi Power Station Explosion

Our recent research report published on 3 August 2021 provided a detailed insight into the “potential” impact of a diminishing and intermittent electricity supply from South Africa’s national power utility (Eskom) on the future of South African Platinum Group Metal (PGM) mine supply.

The objective of this review was to provide evidence and timing to support the view that Eskom’s electricity supply shortage will not likely be neutralised or reversed by 2030 without the timely replacement and new capacity provision of coal, gas, wind, storage and solar power.

The outcome of this objective allowed us to determine the degree and level of load shedding and possible impact on PGM supply from South Africa in particular.

Our review on 3 August painted a bleak picture of Eskom’s ability to provide sufficient renewable energy to satisfy demand and came to the conclusion, supported by the views of experts, that:

It is most likely that the energy gap will widen significantly over the next five years, primarily

caused by:

- the low energy availability factor (EAF) of existing coal-fired plants

- a (three to four year) “slippage” in the newbuild programme and,

- capital constraints (factoring in the inability to attract foreign direct investment and state-wide corruption).

As a result of political interference, meddling and vacillation with respect to the proposed recovery plan, this energy gap will most likely cause a significant drop in PGM supply. PGM supply from South Africa will probably start to decline within the next two to three years if indeed, the frequency and higher stages of load shedding persist ceteris paribus.(NB. Stage 6 load shedding and higher would cause mining operations to cease).

This update highlights additional information that has been recently reported and which further corroborates my previous conclusions.

Firstly, it is important to acknowledge that Eskom is insolvent and is not generating anywhere near enough cash to fund its current operations or indeed, to service its R401bn (US$27bn) debt. So where will the money come from? Eskom’s CEO André de Ruyter is seeking a multi-lender loan facility from development finance institutions that will be paid out in segments over several years. Mandy Rambharos, head of the Eskom department that is leading the transition, has previously said it could cost US$10bn (about R150bn) for around 8,017MW worth of projects.

Bloomberg Green confirmed that South Africa is the 12th largest emitter of global emissions and according to Eskom’s CEO, Eskom and South Africa have less than 100 days left to get a “just energy transition plan” into place if they are to access the window of opportunity presented by concessional climate financing by the energy councils or face the risk of losing out to other countries.

According to Businesslive, there is a further problem, in that concessional climate financing will likely be linked to a faster retirement of Eskom’s coal fleet than envisaged at present. In my view, this will present Eskom with a further insurmountable task of supplying additional renewable energy.

The effect of “slippage” in both funding and construction will extend the “slippage factor” significantly, This will heighten the risk of higher stages of load shedding in the near future which will likely then amplify the risk of PGM supply loss, everything else being equal.

De Ruyter also indicated a further risk to its transmission infrastructure. This risk is associated with its ageing infrastructure and insufficient transmission infrastructure, especially in the west of the country. De Ruyter indicated that transmission lines take about seven years to build and an estimated R117.8bn (US$7.98bn) will need to be invested in 8,000km of transmission lines. In my view, this additional transmission comes close to putting the final nail in the coffin insofar as Eskom’s ability to achieve its plan in a timely manner are concerned.

The CSIR has just released its “Statistics of Utility-Scale Power Generation in South Africa, H1 2021”. This report indicated that:

- 2020 suffered the most intensive load-shedding in five years.

- There were a total of 859 hours of outages and 1,798 Gigawatt hours (GWh) of energy shed in 2020. This was the highest calculation since 2015 when the duration of power outages hit 852 hours.

- The CSIR indicated that South Africa had experienced load-shedding for 650 hours in the first half of 2021, while 963 GWh of estimated energy was shed. This is 76% of the total load-shedding experienced throughout 2020.

- According to the CSIR, the extent of load-shedding experienced was largely driven by the declining energy availability factor (EAF) of the existing coal fleet where overall the EAF was 61.3% for H1 2021 (relative to 65% in 2020 and 66.9% in 2019). Clearly, the expected improvement in the EAF has not yet materialised.

- The CSIR noted that a concerning shift of the unplanned outage component of the EAF has also been highlighted where unplanned outages of up to 15,300MW were experienced and were greater than 10,000MW for more than 80% of H1-2021.”

The findings of the CSIR do not bode well for the likelihood of Eskom achieving its widespread rebuild plan.

In summary, the PGM supply from South Africa will, in my view, almost certainly start to decline within the next 2 to 3 years when higher levels and frequency of load shedding persist; at the same time that industrial and investor demand for Platinum is forecast to dramatically increase. The future demand for PGMs is all about climate change and the drive for net zero emissions by 2050.