WHICH WE ARE PLANNING TO SEND OUT EVERY 4 TO 6 WEEKS WITH MARKET UPDATES

Our team has been working flat out as a result of the rapid global changes and enormous global black-swan event of

Covid-19. Economic, deflationary stoppage has literally brought the world to its knees, affecting every economic region of

the planet in unison. We are now in the teeth of a global debt deflationary crisis and insolvency event. Our macro research

is pointing to a truly historic monetary debasement ahead, something which we have been researching and clarifying for

our clients for a number of years now.

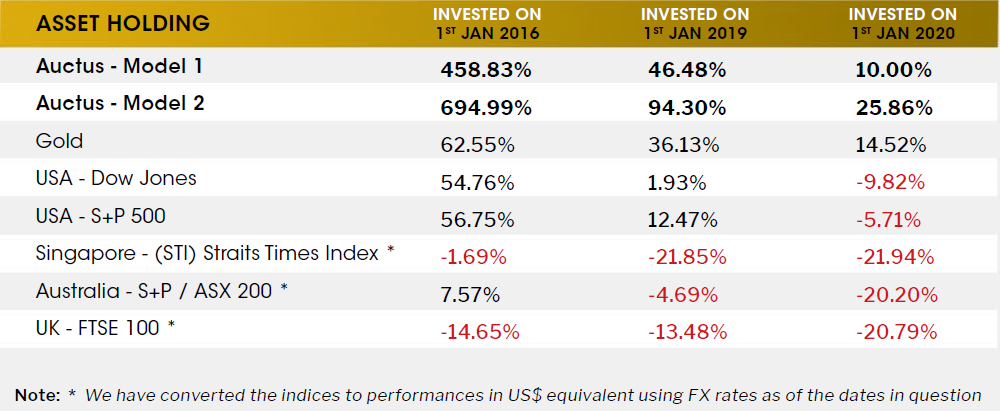

Auctus models continue to outperform the market, not-withstanding the capitulation in metal price valuations in March,

which very closely mirrored the price action of 2008. This was similarly caused by margin call events and were triggered

by substantial falls in the stock markets at the time.

With major stock indices falling over 50% in just 1 month (from February to March 2020) precious metals were used to

provide liquidity to shore up margin calls in cash for financial institutions. It was clear that this deflationary collapse would

be countered in equal measure by global sovereign policy makers. Sure enough, in March and April alone they triggered a

tsunami of monetary debasement, US$10.6 trillion in QE (money printing) and US$10.2 trillion in Fiscal Expansion globally,

i.e. a total of US$20.8 trillion in just 2 months alone or 20% of global GDP. These numbers are truly phenomenal.

MOVING FORWARDS, WE ARE VERY EXCITED ABOUT OUR CLIENT’S PORTFOLIOS IN AUCTUS

FROM A NUMBER OF DIFFERENT DIRECTIONS WHICH WE WILL SUMMARIZE BELOW

(in-depth reports on these developments will be shared soon).

As a quick synopsis of Auctus’ performances compared to Gold and some of the world’s stock markets as of

the 1st June 2020

As we all know, markets do not move in straight linear lines and price volatility is extremely healthy in building the

prognosis for the price direction and appreciation. David Mitchell pointed out 2-weeks ago that we were looking

at short term cycles indicating the next phase of a mini counter-trend.

Bull markets tend to take the stairs, 2 steps up and 1 step back, 3 steps up and 2 steps back. Until the final blowout

top, when 80% of the overall moves takes place in 20% of the cycle time frame. The cycle is an 8.6 years Pi wave

and we are thus expecting big price surges from mid 2022 into late 2024, where the markets for precious metals

will then ‘take the elevator’ instead of the stairs. This is strongly supported by the ongoing global macroeconomic

picture and the governments’ declared policy of monetary debasement.

Gold & Silver were going through a topping process as of the last week of May, with Gold showing signs of already

having seen its peak in the short-term cycle, while Silver has entered a recurring, geometric 13 – 14 week cycle,

when a peak is more likely.

A subsequent low is expected during the next phase of the 7-week cycle (after Gold & Silver fulfilled intervening

cycle lows between May 4 – 8). This next subsequent low is targeted for June 22 – 26, before the continued

upswing in precious metals continues.

Based on the price action in May, all the metals are now expected to set “higher lows” in late June. That would

then turn the focus to the next phase of Gold’s 27 – 29 week cycle, with another cycle peak in September ’20.

Platinum rallied sharply after plunging to its lowest level since 2003, a very important 17.2 year Pi Cycle (very

bullish) has been achieved (2 x 8.6 years), while also fulfilling a 4.3-year cycle that bottomed in the 1st Quarter of 2020 Platinum then surged into late-May. As a result, consolidation is most likely in June & July, with ‘potential’

to mirror the other metals (Gold and Silver) by dropping into late June.

PLATINUM GROUP METALS (PGMs)

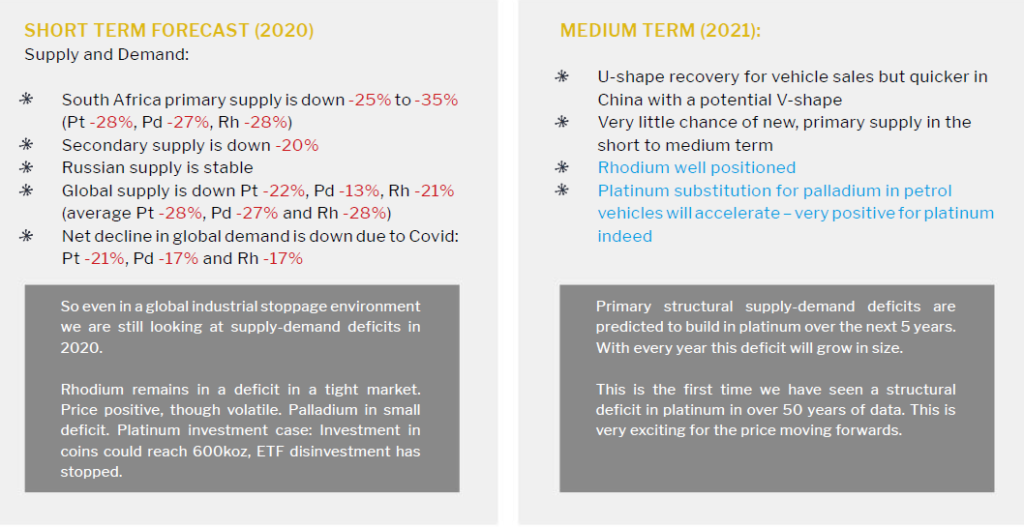

Approximately 75% of all Platinum and Rhodium mine supply comes from just one country: South Africa. The situation

that has developed is a widening in industrial demand for these metals (reloadings in catalytic converters, hydrogen fuel

cells and an array of new industrial usages reliant on its specific qualities) combined with their falling mine supply. This is

an enormously exciting investment thesis, even in the face of an industrial slowdown and economic crisis.

As you will understand: In the Covid-19 environment there is a heightened complexity to any forecasting 2020 – it is

fraught with a myriad of fast changing global economics and environmental dynamics. There are however, enormous

challenges ahead for South African mines:

SILVER

Global mine production fell for the fourth consecutive year in 2019, dropping by -1.3% y/y to 836.5Moz (26,019t). This was

a result of declining grades at several large primary silver mines, lower silver production from copper mines and notable

disruption losses and mine closures at some major silver producers. The year 2020 will record the fifth consecutive fall in

global mine production.

Overall, global supply (including recycling) is forecast to fall by -4% to 978.1Moz (30,424t) in 2020, its lowest since 2009.

Silver fabrication and industrial demand has been increasing every year since 2012, while import demand from India has

increased substantially since 2008.

Meanwhile the depression dynamics have taken a hold of the price of silver and driven the undervaluation of the white

metal to such extremes that we have hit all-time historical recorded highs in the Gold Silver Ratio (a high of 125 to 1). To

put this into its proper perspective, the mining supply ratio globally is only 8 to 1.

Major cycle bottoms are always followed by new major cycle revaluations and with direct debt monetisation

globally (either on its way or already here in some cases) alongside the green energy properties of silver and its

dramatically growing presence in the medical field (silver has specific antibacterial properties that no other metal has

demonstrated) we remain very bullish on silver.

Overall a very bullish setup indeed for all of our Auctus Metal Portfolios moving forward.

If you need any help or further information please contact our team via: [email protected]